Updates from Letty – April 1, 2022

Blog posts are the personal views of Letty Hardi and not official statements or records on behalf of the Falls Church City Council

Dear Friends,

We had a big meeting this week with two headlines: we kicked off budget season (8.5 cent tax rate reduction proposed) and Founders Row 2 was up for a final vote (5-2 vote to proceed). And today, the new 5¢ plastic tax goes into effect at grocery stores, convenience stores, and drug stores, joining the rest of the region.

I’ve heard from many people about the significant increases in their real estate tax assessment. We are just at the beginning of budget season, so I hope you will tune in over the next month. The budget is one of the most important decisions we make each year – it funds the core services you expect from local government: public safety, schools, recreation, trash and recycling, roads and sidewalks, and more AND reflects the values and aspirations of our community. Read on for my preliminary thoughts and upcoming opportunities where you can engage. You can also submit your comments via email to all of us.

This is also a good time to make a plug to join the Board of Equalization. The BOE is one of our boards and commissions and considers taxpayers’ petitions regarding real estate assessments made by the city assessor. The BOE has the power to order an increase, decrease, or to affirm the assessment in question. Apply here!

I look forward to hearing from you.

Best,

Letty

What Happened This Week:

(1) FY23 Budget

Quick Links:

- City Manager’s proposed budget presentation (more budget docs here)

- School Board’s proposed budget presentation (more budget docs here)

- Short videos explaining the capital improvements program (CIP) and city department budgets

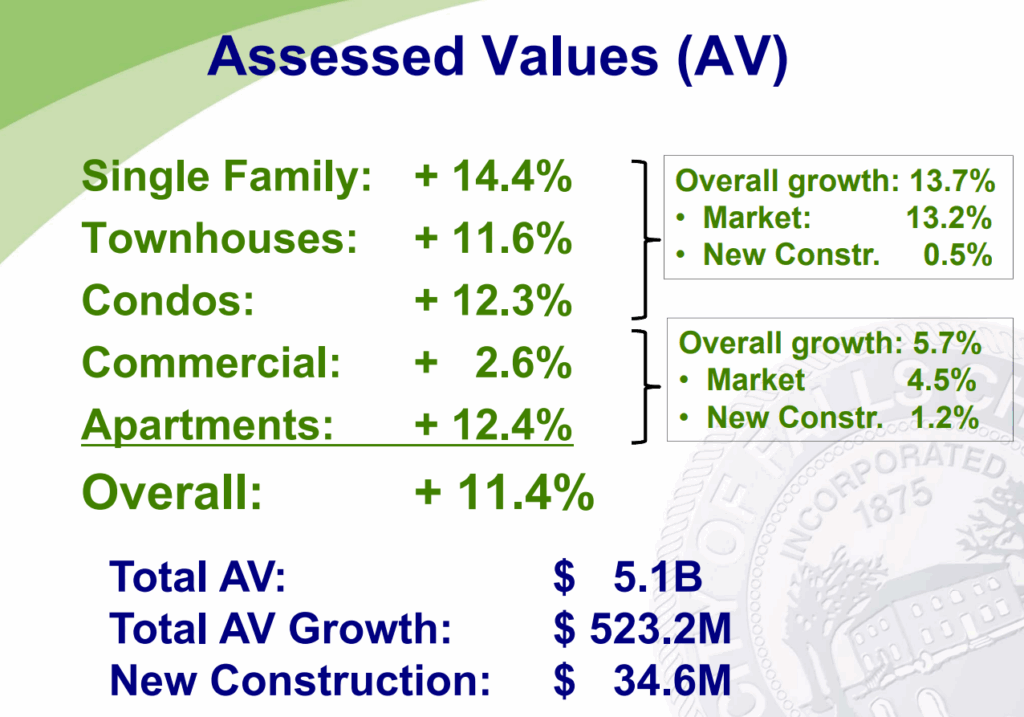

Beyond the headline about the 8.5 cents real estate tax rate reduction to partially offset the 11+% increases in assessments – here are other highlights:

- The proposed budgets represent a 6% increase in the general government budget and a 6.8% increase in the FCCPS budget (6.3% coming from local revenue + 0.5% from state)

- The 8.5 cents decrease is the largest in recent history and among the largest in Northern Virginia. Regionally, the proposed tax rates so far range from no change (Arlington, Fairfax) to 2-4 cents decrease (Alexandria, Fairfax City, Manassas Park) to 6 cents decrease (Manassas, Prince William) to 8.5 cents decrease (Falls Church, Loudoun) – larger tax rate decreases roughly correspond with jurisdictions with the higher assessed values growth.

- As proposed, the current real estate tax rate of $1.32 would drop to $1.235. Without the tax rate decrease, the average homeowner’s annual tax bill would have increased by $1400. With the tax rate decrease, the average increase is smaller, about $635.

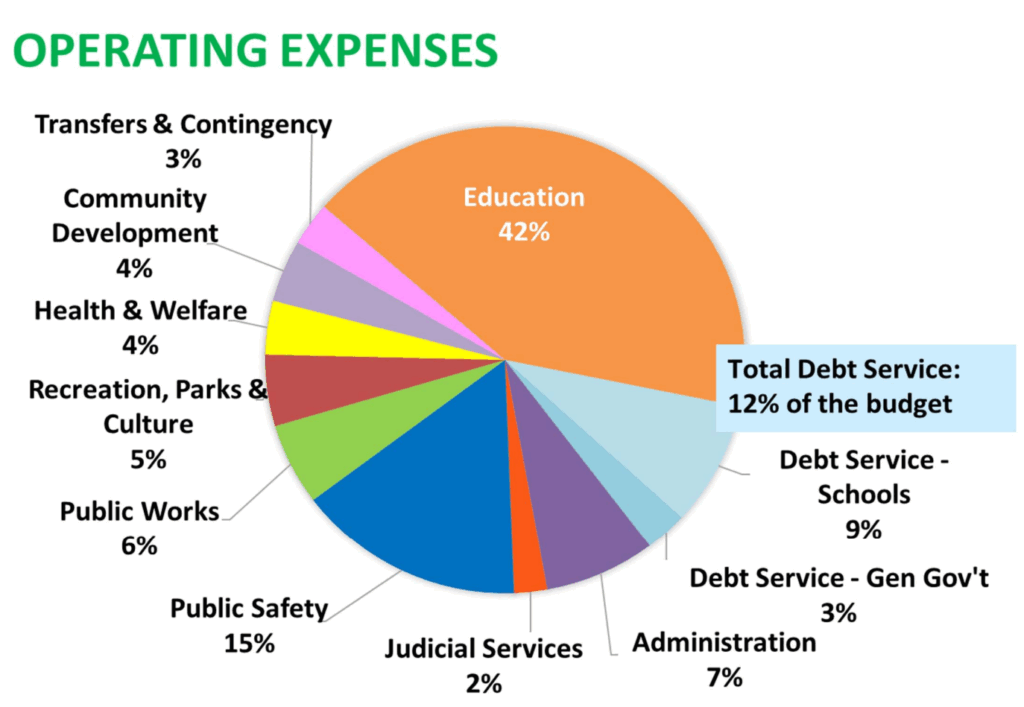

- Key investments include: compensation to regain competitiveness in attracting and retaining employees; add police officers for traffic enforcement; use building permit revenue from new development projects to add new term-limited positions for those projects; and sustain funding for priorities like affordable housing, traffic calming, and sidewalks.

- Car tax – also due to the increasing values of new and used cars, staff is developing options to help blunt that impact, much like the rest of the region.

- Stormwater & sewer fees – there are small, 3% increases in rates proposed for both utilities. The majority of the planned stormwater infrastructure will be funded by federal grants which helps avoid more drastic rate increases.

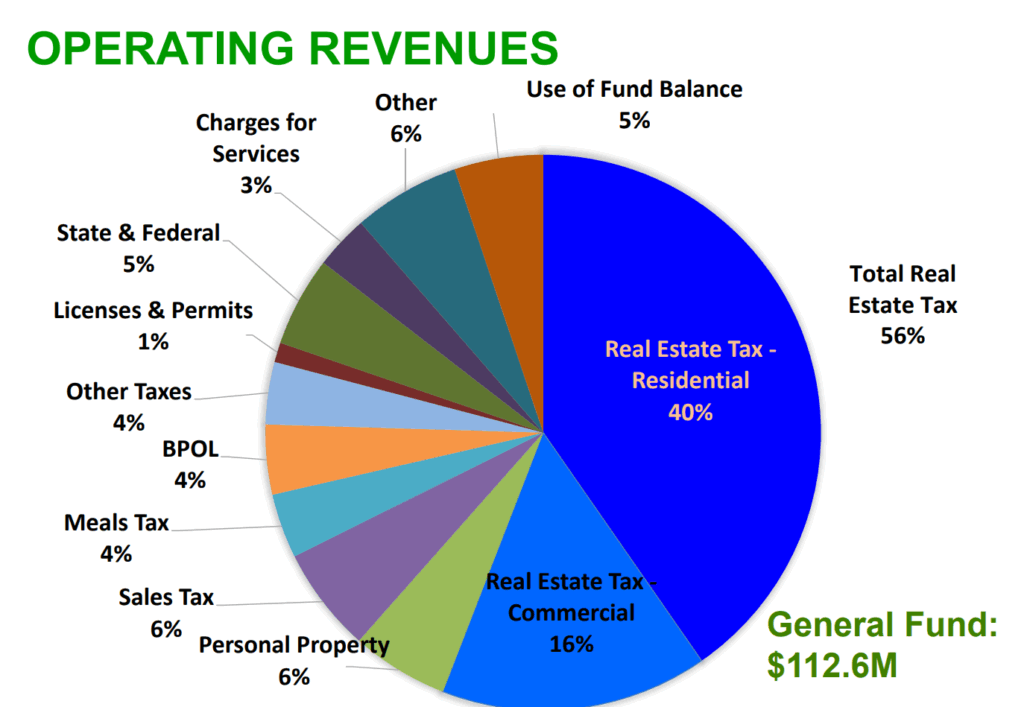

It’s worth noting some details behind the large real estate assessment growth – there is a pretty stark difference in values for residential vs commercial. Much of the AV growth in residential is due to market conditions that you likely have observed in your own neighborhood – Falls Church has been a desirable place to live! For commercial, pure commercial-only buildings saw little growth vs apartments in mixed use buildings saw comparable growth as single family homes/townhouses/condos and also benefited from new buildings coming online. When we talk about “diversifying the tax base” – in the revenue pie chart above, apartments are actually counted as commercial revenue (16% of our total revenue) and contribute to that diversification.

Letty’s thoughts:

In response to the high real estate assessments – a good check is to ask whether you could sell your house for that price and if so, then the assessment is likely accurate – even if it’s a shocking jump. If you don’t believe so, you can file an appeal with both the assessor’s office and Board of Equalization.

I realize that even with the tax rate cut, the impact is still significant for many households and you don’t necessarily realize that increased value unless you sell your home or refinance and take out the equity. When I talk about the importance of affordable housing – not only do we need to keep up the momentum to welcome lower income households, but I believe we should aspire to be a city for the full spectrum of income levels. It is unsustainable for us to be a community that only builds new rental apartments and large single family homes, where “middle housing” and middle income earners are excluded. That said, the current inflationary environment challenges us to keep up with the rising cost of materials, services, and competitive salaries to retain employees. And the budget needs to reflect priorities we’ve heard like traffic calming, sidewalks, equity work, stormwater – not to mention paying for all the capital infrastructure we built recently and funding the schools’ requested budget.

I continue to think our future is bright. A combination of factors gives me hope that there will be more opportunities for tax rate reductions for some time: we lowered the tax rate last year in the middle of the pandemic + the infusion of federal and grant dollars (albeit one time funds) + the queue of economic development we’ve set in motion. I will also continue to advocate for expansion of our disabled and senior tax relief program so those who need assistance the most will receive it. Over the next month, we’ll be digging into the budget to weigh priorities and our fiscal responsibility – your input will be important!

(2) Founders Row 2

We also voted 5-2 to advance Founders Row 2, which has been iterating through the city’s development process the past two years. The project will bring 280 units of housing and 27K square feet of commercial space to replace the out-of-business Rite Aid and carpet store at Broad and West. Besides strong fiscals, the project will also achieve new standards in environmental sustainability (first fully electric residential units, LEED Gold, stormwater capture, 28% open space, 14% tree canopy coverage) and will improve transportation and pedestrian safety with a long-requested new north-south pedestrian/bike path, new signal timing, traffic calming, and crosswalks.

It’s also notable that the developer is proposing two new significant achievements in affordable housing: 12% of the units will be permanently affordable, which is 2x the city’s current policy. Also for the first time, some of the units will be set aside for households at 40% area median income (AMI) level. We are sorely lacking housing in these deeper affordability levels. (40% AMI represents households who earn about $50K/year in a family of 4.)

Letty’s thoughts: With forward progress on securing a new theater tenant at Founders Row 1 across the street and other announcements of retail tenants, I believe the developer has shown good faith in honoring their commitments and satisfactorily addressed the majority of the feedback collected from boards and commissions, City Council, and the neighborhood. No project is ever perfect, but this one has significantly improved and I saw no major issues that were left unresolved. As I’ve said before – housing should not be a bad word. With housing being in short supply across the region – this is an important way for us to welcome more residents into our community as the impacts are understood and mitigated. And as we discuss budgets and the tax rate, it’s timely to note that new development creates the opportunities to continue to bring down the tax rate – Founders 2 is expected to bring $450K net fiscal revenue to the city each year, which nearly equates to 1 penny on the tax rate.

What’s Coming Up:;

Friday, April 1, 2022 – New 5¢ Plastic Tax Begins

Monday, April 4, 2022 – City Council Work Session*

Monday, April 11, 2022 – City Council Meeting (budget first reading vote)*

Monday, April 18, 2022 – City Council Work Session*

Thursday, April 21, 2022 (7 pm) – Budget Town Hall #2

Monday, April 25, 2022 – City Council Meeting*

Monday, May 2, 2022 – City Council Meeting (budget adoption)*

*every Monday (except 5th Mondays and holidays) at 7:30 pm. You can access the agenda and livestream here, including recordings of past meetings