Updates from Letty – April 20, 2018 – budget edition #4

Blog posts are the personal views of Letty Hardi and not official statements or records on behalf of the Falls Church City Council

Dear Friends,

Thank you for all of the great feedback on last week’s FAQs post. When these updates get passed around by you and I am reaching more people about “boring city news”, I’ve appreciated hearing that this information is useful and that my efforts are worth it! Please keep sharing.

We’re in the final days before this year’s budget adoption. We got clarity on the Metro funding wild card as the news came out of Richmond on Wednesday night, but it’s not as simple as what you may be reading. The bottom line: we won’t need to raise real estate taxes as high as the original “worst case scenario”, and the tax rate increase will be 2.5 cents at the maximum. However, the Virginia plan for funding for Metro is a classic “rob Peter to pay Paul” scenario, so the entire Northern Virginia region is assessing how other transportation projects will be impacted. For a good read on how the region is reacting, see here.

Everyone takes a tax increase seriously. If we adopt 2.5 cents increase next week – coupled with the increased property tax assessments you already received back in February, the total annual impact for the median homeowner (home value of $675K), is a $431 increase. That includes $262 from the increased market value of your home + $169 from the 2.5 cents tax rate increase. If the “guidance budget” passes, the tax rate impact is 1.65 cents increase, resulting in about $374 increased taxes to the median homeowner. Realistically, we have so made so much progress in bringing down the tax rate increase needed that I believe the tone of of the discussions matter far more. The difference between the School Board’s 2.8% request and the 2% guidance is less than $350K in a $90+M budget and the difference in tax bill is about $50. ICYMI, this is how I’m thinking about the budget vote and the big picture.

Beyond tax rates, as I highlighted last week, we had a more in depth discussion on expanding senior tax relief, so read on if you’re interested in the program and believe in helping more seniors stay in town. It’s one of the more important public policy discussions we’ve had recently. Like affordable housing, I believe this an important opportunity for us to live our values and balance multiple needs across the city.

We get any 5th Mondays of the month off, so after the budget is done, we’ll be back to work on May 7th for a work session.

Best,

Letty

What Happened This Week

(1) FY19 Budget – Metro funding

Virginia’s funding of Metro at $154M is historic news and important for our local economy, the region, and the state. And having the local impact reduced from the worst case scenario (2.5 out of the original 5.5 cents tax rate increase) puts much less pressure on tax rates, so also great news. The more complicated news: the Governor proposed amendments to add two new sources of revenue (grantor’s tax and hotel tax, limited to the NoVA region) but they were rejected in the House, so the $154M will partly come from transportation dollars planned for other projects. If you missed the link above, this Washington Post article is helpful in understanding the impact to Northern Virginia.

(You may be reading about the NVTA. NVTA is the Northern Virgina Transportation Authority, which is a regional body that collects taxes from the region and has bonding authority in order to allocate those revenues for transportation projects in Northern Virginia.)

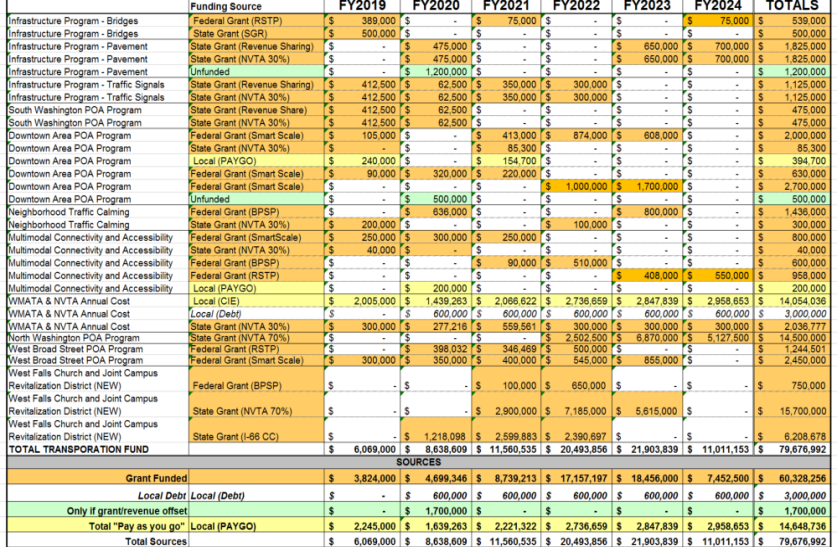

All of Northern Virginia is figuring out how the rejection of the Governor’s amendments impacts their projects that were to be funded by NVTA – some are road projects that many of you use in your commutes, some are projects closer to home like pavement work, traffic signals, neighborhood traffic calming, etc. From a recent presentation about the CIP, here is a view of Falls Church’s transportation funding and planned schedule, so you can see the orchestration and breadth of transportation funding sources (and frankly, how much everything costs) and how we try to make local dollars go further.

If you can read the chart, note that we have a grant application for $15.7M to improve the safety, walkability, and Metro access at the Haycock/Shreve/Rt 7 intersection. $15M would significantly improve that corridor, especially for commuters, MEH and GMHS students, staff, and the campus project – and clearly would be difficult for us to afford to do on our own. More on that next time I blog, in case you’d like to help advocate and help the City win the grant.

(2) FY19 Budget – recap

If you’re just tuning in, here are some helpful links on the budget:

- City Manager budget presentation (1.7% increase requested)

- School budget presentation (2.8% increase requested)

- Budget Q&As – these are questions we ask during the budget process

- My blog posts about the budget

(3) FY19 Budget – if your head is swimming in numbers, here’s some “tax rate math”:

Recall we started the budget process 6 weeks ago with a proposed budget by the City Manager for 5.5 cents, which included 2.5 cents needed to fund Metro. It also included the 6 cents to fund the CIP. The tax rate increase needed was partially negated due to savings in operations budgets (revenues stronger than expected + constraining budgets).

2.5 cents for Metro + 6 cents for CIP = 8.5 cents

8.5 cents – 3 cents from operations budget savings = 5.5 cents proposed in March

Two things happened during the budget process that reduced the tax rate increase needed. As I wrote about last week, because we’re issuing $7M less debt than originally planned, we have less debt service for the CIP needed in this year’s budget, or about 1 penny less. (Don’t forget that means the $7M is just deferred, not canceled, so we it will come back in future years.) Also, due to the Metro funding I wrote about above only requiring half a penny, the maximum tax rate needed is 2.5 cents.

0.5 cents for Metro + 5 cents for CIP = 5.5 cents

5.5 cents – 3 cents from operations budget savings = 2.5 cents (or 1.65 cents if we hold operating budgets to guidance)

(4) FY19 Budget – what are the options?

In Monday’s agenda, there are two versions of the budget ordinance. One funds the full School Board request of 2.8% increase (2.5 cents increase) and one for the original 2% guidance. (1.65 cents increase).

Letty’s thoughts: Clearly there is an argument that says we should fund the school request because it’s lower than it’s been and because Metro funding turned out better than originally thought (“2.5 cents is way less than 6 cents!”) that we should have more room to accept budget increases above guidance. On the other hand, there are ones who stick to the original guidance based on the risks ahead, the ambitious capital plan, and long term sustainability of the City’s tax rates. I also see a 3rd way where I hoped a compromise solution would be reached, as the amount being debated is insignificant in the broader picture. Instead of debating $350K in this year’s budget, the tone matters here. We should focus on bigger and more impactful opportunities ahead like the $15M grant request (see above) and of course, the GMHS project where compromises and cooperation will be needed all around.

At the time of writing this week’s blog post, I am continuing to weigh all of these thoughts as I consider the budget vote. Friends, colleagues, and long-time readers will know that I approach these decisions rationally and with much thought and care! If you missed my Guest Commentary a few weeks ago, I hope you’ll read to understand how I’m thinking.

(5) Senior Tax Relief

The Treasurer presented a good overview of our current tax relief program, how many people we help, and how the program could be expanded. Quick facts:

- Out of 4592 real estate parcels, 54 are in the relief program. Some are seniors, some are disabled, some are disabled vets, some get car tax relief only, etc.

- You can get “relief” by a pure tax exemption or a deferral based on asset limits and income brackets. A set amount of taxes that can be exempted depending on income. Deferrals are charged interest based on the Prime rate and don’t have very high usage. For example, in the lowest income bracket of $0-22K income per year, up to $4K of property taxes is exempted. If you have taxes above $4K, you can defer the overage. Page 1 of this chart compares our current program to neighbors’ programs.

- The Treasurer proposed two options – either would cost $45K in the budget (tax relief is done on a calendar year basis so if approved, it would go into effect in 2019. It would cost us $45K in FY19, $45K in FY20, and $90K annually going forward).

- Expand from maximum $4K exemption relief to 100% relief for the lowest income bracket

- Raise income limits to be more in line with neighbors and offer interest-free deferral

- The modeled impact is shown on page 2 of this chart.

- While the maximum relief amounts were adjusted in 2014, it has been awhile since we adjusted the income brackets. Interest-free deferral also seems to be a fair way to help keep seniors in their home longer, while being able to recoup the interest on the back end. We agreed that a committee would be formed to further discuss and get input from the senior population. We would revisit with a committee’s recommendations later this year, in time to enact the ordinance before January 2019.

(6) Good Stuff to Know

Virginia Women’s Monuments – as the liaison to the Arts and Humanities Council, we heard from former Senator Mary Margaret Whipple this week about public art + women – Virginia’s first monument to women, to be placed in Richmond’s Capitol Square. Twelve women were selected to represent over 400 years of Virginia history. Fundraising is underway, so if you’re interested in supporting or learning more about the women selected – see here: http://womensmonumentcom.virginia.gov/.

Boards and Commissions – speaking of boards and commissions, there are several vacancies to consider as a way to dip your toe into getting involved in Falls Church. For example, if you’re interested in arts, culture, and history – a new seat for an At-Large member for the Arts & Humanities Council was recently created. I’m happy to answer any questions you have about what these various B&Cs do if you’re considering applying for a spot.

What’s Coming Up:

- Today – Friday, April 20 – Economic Development Committee – 9 am, Dogwood Room, Temporary City Hall (400 N. Washington)

- Tomorrow – Saturday, April 21 – Arbor Day Celebration – 1 pm, Cherry Hill Park (near basketball courts)

- April 23 – City Council Meeting (final budget adoption) – 730 pm

- April 27 – Campus Coordinating Committee meeting – 730 am, Central Office

- May 7 – City Council Work Session – 730 pm