Updates from Letty – April 21, 2022

Blog posts are the personal views of Letty Hardi and not official statements or records on behalf of the Falls Church City Council

Dear Friends,

You may notice that this week’s post is about 12 hours earlier than usual – I’m hitting your inboxes early as a reminder to tune into the final budget town hall tonight (Thursday) at 7 pm. We’re also happy to hear from you via email or during public comment at our meetings the next two Monday nights (4/25 and 5/2). We are quickly approaching the end of budget season – after a meaty work session this week to prepare for the “mark up” session next week, we’ll be adopting the FY23 budget on 5/2. Read on for the priorities I’m advocating (speed enforcement, sidewalks, bike lanes, tax relief, refugee housing, and more) based on my conversations with many of you – I’d welcome your continued input. For financial policy wonks and budget hawks, do read to the end for my thoughts on our very healthy reserve picture – which I think needs to be a bigger part of our budget discussions.

Finally, a new thing we’ll be trying out next week: as you know, I’ve been holding monthly one-one-one office hours for years – I find them a valuable way to connect with residents outside of emails and our (somewhat stodgy and formal) meetings. We’ll be piloting City Council office hours next Wednesday morning 4/27 at 9 am in the Oak Room. You can tune in virtually or stop by City Hall, where some or most of City Council will be there to hear from you.

Best,

Letty

PS – a lot has happened over spring break week: the Broad and Washington construction is now well underway, temp traffic light and crosswalk at E. Broad/Lawton, new signs are up with the expanded public parking hours at the Kaiser garage (all weeknights and weekends), median cut and traffic signal work at N. Washington/Park Place is in progress. Official groundbreaking event is scheduled for next Friday.

What Happened This Week:

All Things Budget

Quick Links:

- City Manager’s proposed budget presentation (more budget docs here)

- School Board’s proposed budget presentation (more budget docs here)

- Short videos explaining the capital improvements program (CIP) and city department budgets

- Latest Budget Q&A – City Council & public questions answered!

Quick Recap:

- The proposed budgets represent a 6% increase in the general government budget, a 6.8% increase in the FCCPS budget (6.3% coming from local revenue + 0.5% from state), fully funds the School Board’s adopted budget, and funds employee raises with parity across general government and school staff.

- Tax Rate Decrease – 8.5 cents real estate tax rate reduction is proposed to partially offset the 11+% increases in assessments. Without the tax rate decrease, the average homeowner’s annual tax bill would have increased by $1400. With the tax rate decrease, the average increase is smaller, about $635. I realize that is still a significant burden for some, so we will be expanding the senior tax relief program and will look for opportunities to further decrease the tax rate (more on that below)

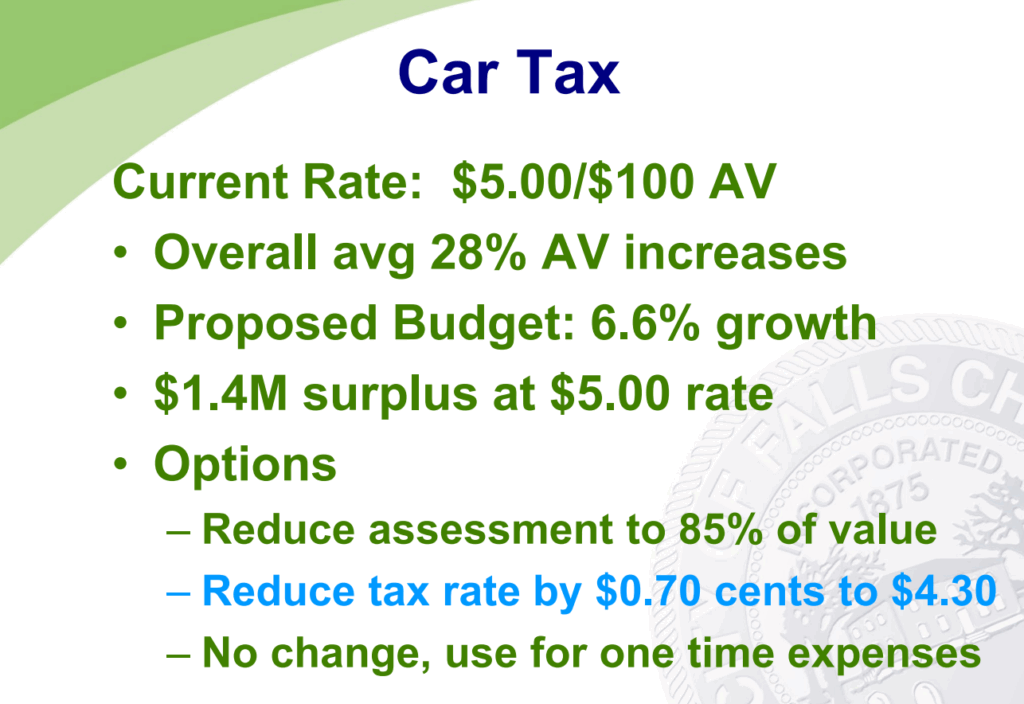

- Car tax – also due to the increasing values of new and used cars, staff is developing options to help blunt that impact, much like the rest of the region (more on that below)

- New Commercial & Industrial Tax – 5 cents proposed to be assessed only on commercial properties (more on that below)

- Stormwater & sewer fees – there are small, 3% increases in rates proposed for both utilities. The majority of the planned stormwater infrastructure will be funded by federal grants which helps avoid more drastic rate increases.

(1) Car Tax

Similar to residential property, we expect that cars will see much higher assessed values (28% on average!) due to supply chain issues and chip shortages. As such, we discussed two options to provide relief. The recommended option will drop the property tax rate from $5.00 to $4.30 which should mitigate a majority of the bottom line impact to your car tax bill.

Letty’s thoughts: Because we don’t expect car values to stay elevated forever, changing the car tax rate now (instead of reducing assessment values) may lead to more volatile rate changes as we try to adjust in future budget cycles. However, I do support this change as staff recommends it’s the most straightforward way to implement this relief.

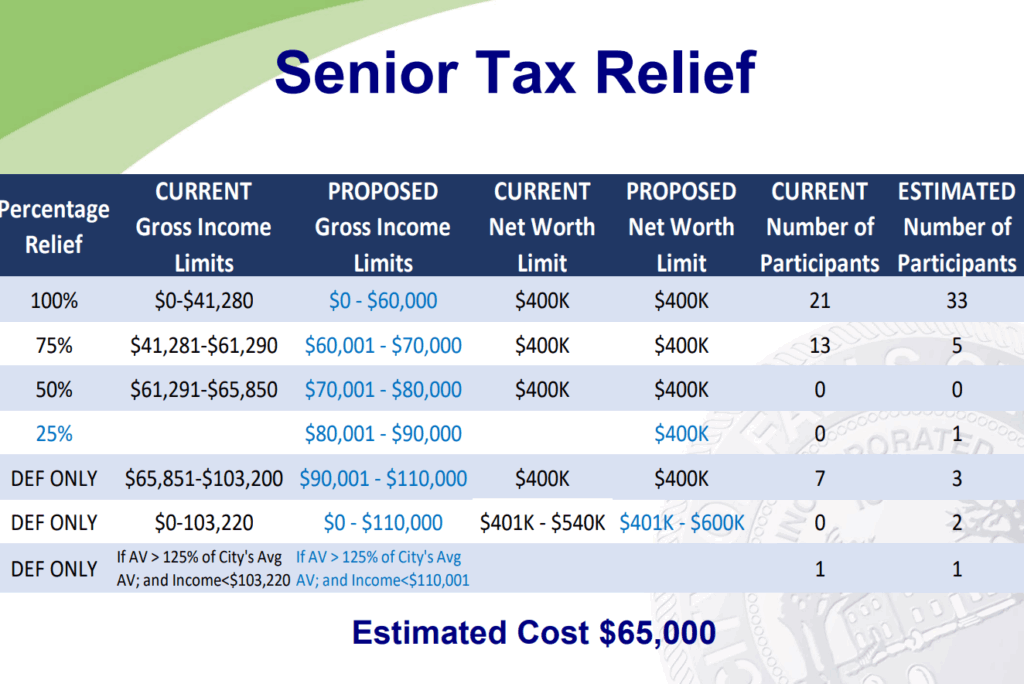

(2) Senior Tax Relief

Expect to see expansion of the senior and disabled tax relief program. We had last overhauled the program in 2019. Given the increased tax burden and increased home prices since then, it’s appropriate to expand income and asset limits to provide relief to our most vulnerable. Proposed expansion limits are below in blue at the cost of $65K in this upcoming budget year, with about $550K in total allocated to the program. Staff has benchmarked the program with neighboring jurisdictions’ programs as well.

Letty’s thoughts: I fully support the expansion of this program and spoke up about further expansion. As proposed, the program only provides relief to a handful of more people so if budget dollars were available, I’d support further expansion to allow more seniors to stay in their homes and slow down generational turnover in our neighborhoods (see my post from 2019 about why I believe this is both compassionate and good public policy).

(3) Automated speed and red light enforcement

As traffic enforcement and neighborhood traffic calming has remained one of the community’s top priorities, automated enforcement technology should be part of the toolbox as it’s unrealistic to have police officers everywhere or have every road immediately be redesigned to slow cars down. Automated enforcement technology, while limited in scope by the General Assembly, has shown to be an effective deterrent.

Letty’s thoughts: I’d like to see expansion of the red light cameras (currently at 2 intersections) and add speed cameras in appropriate school zones. A feasibility study on the school zones speed cameras will be underway this spring. Per our work session discussion and Question 12 in the Budget Q&A – it comes with a cost of an additional $100K to add speed cameras in schools zones and/or expand the red light camera intersections.

(4) C&I Tax

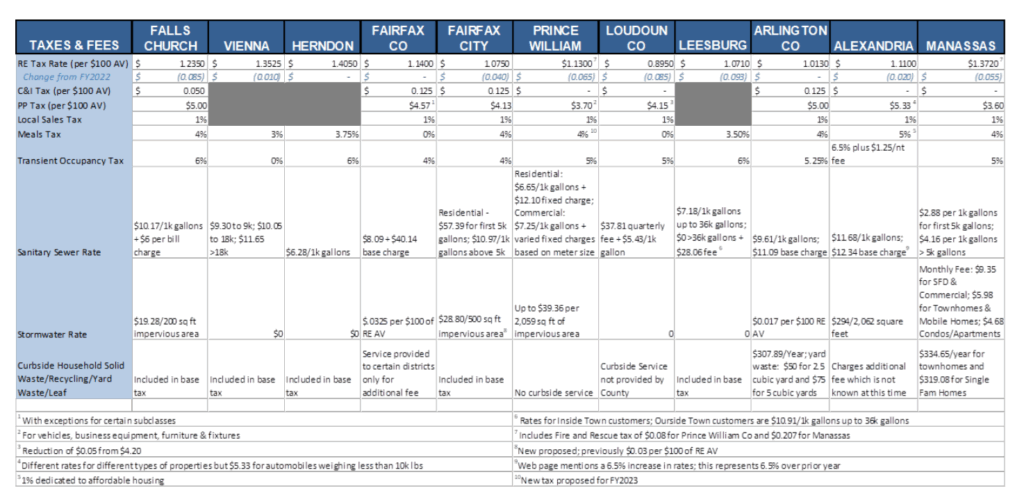

City Manager’s proposed budget includes a new Commercial & Industrial Tax of 5 cents (see line 3 in the chart below for a tax rate comparison chart across Northern Virginia). With the property tax rate reduction of 8.5 cents and flat or only small increases in assessments on commercial property – this new C&I tax would have still resulted in flat or smaller tax bills for most commercial property owners, unlike residential property owners.

That said, we’ve heard loud and clear from the Chamber of Commerce, Economic Development Authority, and many others that this is a poorly timed tax especially after a tough few years for businesses, many of whom are still recovering from the pandemic. I expect that we will shelve the C&I tax this year, but will need to plug that revenue gap of $400K.

(4) Other Budget Thoughts:

City basic maintenance: one of the most important takeaways from our meeting this week is learning that we have severely underfunded sidewalk maintenance and street re-paving. For example, Public Works estimates that $600K/year is needed to maintain the city’s sidewalks, with brick sidewalks that are part of our streetscape standards being more expensive and laborious to maintain. The budget currently has $60K/year allocated to sidewalk maintenance – 10% of what staff says is needed!

Letty’s thoughts: I would like to see more budget dollars allocated to sidewalk repair and re-paving with proposals to add bike lanes once re-paved. Similar to my concerns about the big capital infrastructure we’ve built like the new high school, library, and city hall – we cannot be so focused on only adding new stuff at the expense of maintaining what we already have. Anytime we build new, we should factor in the lifetime maintenance cost so it’s part of our decision-making at the outset and we avoid one off requests for more staff or resources to maintain the new capital.

Welcome refugees: I have been working with Welcoming Falls Church on developing a pilot “Renting to Refugees” initiative where the city commits funding to extend the federal assistance that is given to refugee households, with a goal of welcoming 5 refugee families to Falls Church over the next 2 years. Given the high cost of housing in Falls Church but our generous and expansive resources in the community, the concept is to provide a longer 12-18 month runaway of housing support (by subsidizing rent) so families have more time and ability to become financially self sufficient.

Letty’s thoughts: In light of our welcoming values, this is a great opportunity to live our values via tangible budget dollars so I believe this also merits our support. As proposed, only $50K is needed to pilot the program. This is an innovative public-private program I am hopeful we’ll get off the ground!

Reserves & one time money: for those who have been long time readers, you’ll remember my extensive posts back in 2016-2017 about the financial planning we undertook in order to afford what was known as the “full CIP” – the high school, city hall, and library projects all at once (this is a good blast from the past).

The TL;DR: we took on an extraordinary amount of debt of $145M, revised our financial policies, and bolstered our capital reserves as part of the plan of finance (we have been using reserves, which are considered one time dolllars, to pay for debt service, a recurring expense, which is normally considered a no-no).

The good news is that we are about past the peak of high levels of debt service, the conservative planning and stress testing we did on the financial plan helped see us through the past two pandemic years and maintain our top credit rating, we’re expecting to close on the West Falls Church project at the end of April where we’ll receive our next $4.5M payment to offset the debt service, and we’ve been fortunate to have an infusion of $18M in federal ARPA dollars to help with pandemic recovery and infrastructure like stormwater and affordable housing. And with the recent announcement of the sale of the grad center land to Rushmark for the Hitt HQ and Virginia Tech innovation center, that could bolster our reserves even further by another $8.4M in 2023.

Letty’s thoughts: As you can see from the chart above – our capital reserves are currently quite healthy. Our revised 2018 financial policy calls for 20% of expenditures in reserves (red line) – about $20M – and the projected reserves are well north of that, around $30M. (And that is without ARPA or Rushmark deal factored in.) While no one can predict the future, especially in a high inflationary environment with global turmoil – we should feel very good about the conservative planning and large cushion we have built to help us weather uncertainties. Thoughtfully deploying reserves – whether that is paying down debt or debt service to return money to taxpayers, responding to our community’s priorities like sidewalk improvements, climate change programs, or affordable housing crisis – needs to be part of our upcoming work. I am not advocating that we go on a spending spree tomorrow. Instead, we should be willing to deploy a small percentage of that overage to respond to long held community priorities while monitoring the economy and working on a long term plan to draw reserves back down to policy levels.

What’s Coming Up:

TONIGHT – Thursday, April 21, 2022 (7 pm) – Budget Town Hall #2

Saturday, April 23, 2022 (12 pm) – Arbor Day Celebration

Monday, April 25, 2022 – City Council Meeting*

Wednesday, April 27, 2022 (9 am) – City Council Office Hours

Sunday, May 1, 2022 (11 am – 2 pm) – Women’s History Walk

Monday, May 2, 2022 – City Council Meeting (budget adoption)*

*every Monday (except 5th Mondays and holidays) at 7:30 pm. You can access the agenda and livestream here, including recordings of past meetings