Updates from Letty – April 26, 2019

Blog posts are the personal views of Letty Hardi and not official statements or records on behalf of the Falls Church City Council

Dear Friends,

And that’s a wrap! We adopted the FY20 budget this week in what I guess was record time, wrapping up the budget vote by 9 pm (although our meeting lasted til 11 pm on other business), with no real estate tax increase as expected. Read on for my thoughts about the new budget that goes into effect July 1, including the much debated senior tax relief program.

Also, City Hall has moved back home. After a year+ long renovation and expansion, City Hall has reopened to the public at 300 Park Ave. We’ve had a few public meetings in the new digs this week, but finishing touches are still in progress. Council Chambers won’t be ready until our May 28 meeting and look for more info for a public ribbon cutting in early June.

Don’t miss April’s Town Hall next Monday night, April 29 at 730 pm. This is an important one as it is the last one before our planned vote on the West Falls Church project, scheduled on May 13. Our next Council meeting will be the May 6 work session. You can always send us your questions and comments as well. And this morning, the monthly Campus Coordinating Committee is meeting bright and early at 730 am, School Board offices, where the GMHS and economic development teams coordinate the parallel projects.

Best,

Letty

PS – In celebration of Earth Day 2019 this week, I posted environment-related events this weekend – the weather should be drying out, so a good weekend to celebrate and protect Planet Earth.

What Happened This Week:

(1) FY20 Budget & CIP Adoption

The big news this week was the 7-0 adoption of the FY20 budget and capital improvements program. It largely reflects the budget that was presented to us (see my first blog post for the more thorough recap). Key highlights:

- No increase in property tax rate, while fully funding the school budget request and the city manager’s budgets. The increase in the budget is funded out of organic revenue growth (ie, tax revenues growing naturally due to market appreciation of real estate values, increased spending by consumers driving revenues like sales and meals taxes, etc)

- Salary raises all around – both general government employees and school employees and teachers will receive raises. Our impressive small class sizes in the schools will also be maintained.

- We add several positions, including a police officer, HR director, and building inspectors, returning general government staffing to pre-recession levels

- We fund our WMATA obligation

- Additional funding for senior tax relief, pedestrian improvements, traffic calming, traffic signals, park trails

Letty’s thoughts:

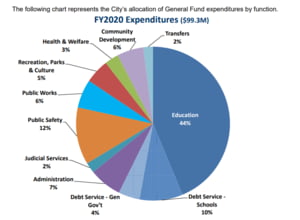

This year budget now tops $99M, which is 7% bigger than last year’s. It’s not lost on me that my first adopted budget, 3 years ago, was just over $86M and now we’re nearly at $100M! The most extraordinary growth in our expenditures this year is the jump in debt service for the capital projects we’re undertaking, ballooning to 14% of our total budget. For context, that is about what we spend annually on Parks, Public Works, and Human Services *combined.*

It is also notable that this year’s budget process has been far and away better than years past. We’ve been fortunate to have better than expected real estate values growth, less student enrollment pressures, and general goodwill and cooperation knowing that we’re taking on extraordinary capital projects, which has de-freighted the typical budget anxiety. Much thanks and kudos to all for keeping it a drama-free budget.

We’ve spent the last 3 budget cycles preparing for this big lift with “belt tightening” of our operating budgets, a few judicious tax rate increases (3.5 cents total), and economic development plans, in what would otherwise be 15 cents on the tax rate if we were to pay for the new high school, library, etc outright, all at once. We still have a long road ahead and likely harder budgets to come, so my hope is that in thick and thin, the good vibes continue.

(2) Senior Tax Relief – what happens next?

The approved budget includes an additional $63K to the senior tax relief program – bringing the total budget to about $390K, which is 0.4% of the $99M total operating budget. While I have been a strong advocate of this program and supported the increase as a commitment to generational and socioeconomic diversity – there is more discussion planned at our May 20 work session to work out the mechanics of the program changes. The budget vote only required the allocation of money to the program and we did not approve any program changes or how much would be set aside for tax abatements vs tax deferrals, which is a misconception I’ve already fielded. We actually have until July to roll out changes to the program.

The task force we charged last year to expand and benchmark our program with other jurisdictions provided us a plethora of recommendations, including changing qualifying income and asset levels to be in closer alignment with peers, accounting for property values in whether to grant abatement or deferral, and removing the interest charge to increase usage of the deferral option. My blog post from early April includes more details and links to the task force’s recommendations. Working through those recommendations, and implications of those recommendations, will be covered in the May work session.

So if you have thoughts on how you’d like to see the senior tax relief program change, it’s not too late to share them with us.

What’s Coming Up:

- TODAY, April 26 – Campus Coordinating Committee Meeting (730 am, School Board Office)

- Monday, April 29 – “Sunday Series” (730 pm, Community Center)

- Monday, May 6 – City Council Work Session (730 pm, Community Center)

- Monday, May 13 – City Council Meeting (730 pm, Community Center)

- Monday, May 20 – City Council Work Session (730 pm, Community Center)

- Tuesday, May 25 – City Council Meeting (730 pm, City Hall)