Updates from Letty – April 30, 2021 – Final Budget Edition

Blog posts are the personal views of Letty Hardi and not official statements or records on behalf of the Falls Church City Council

Dear Friends,

We had a busy 48 hours in Falls Church this week: on Monday night, we adopted the FY22 budget with a 3.5 cents lower tax rate – the first time we’ve decreased it in over 15 years! The fact that our deliberations the past few weeks were over *how much* to lower the tax rate requires pause and acknowledgement. It is remarkable that coming off a global pandemic and the year the new high school and new library open that we’re able to achieve this. We’re glad to be able to alleviate some of the burden in this difficult year while continuing to deliver top notch city services. Read on about several important firsts in this budget and how the tax rate decrease was possible.

And on Tuesday night, two of our five schools received new names, effective this summer. Kudos to my School Board colleagues for navigating that process with the community and to the many voices that chimed in. If you’ve been passionate about school renaming, I hope we’re all ready to channel that energy into other justice work.

Finally – as vaccine supplies continue to increase, there are more ways to get a shot. Besides looking online either through vaccinefinder.org or VAMS, the Tysons mass vaccination site at the former Lord & Taylor is now open for walk ins. Falls Church’s vaccination rates appear to lead the region, with over 50% of the population with 1 dose and almost 32% of the population fully vaccinated. Please keep encouraging friends and neighbors, and let me know if anyone is having language, technology, or transportation issues in getting a vaccine so we can help.

Take care,

Letty

PS – See you at Sunday’s Women’s History Walk!

What Happened This Week:

(1) FY22 Budget Adopted

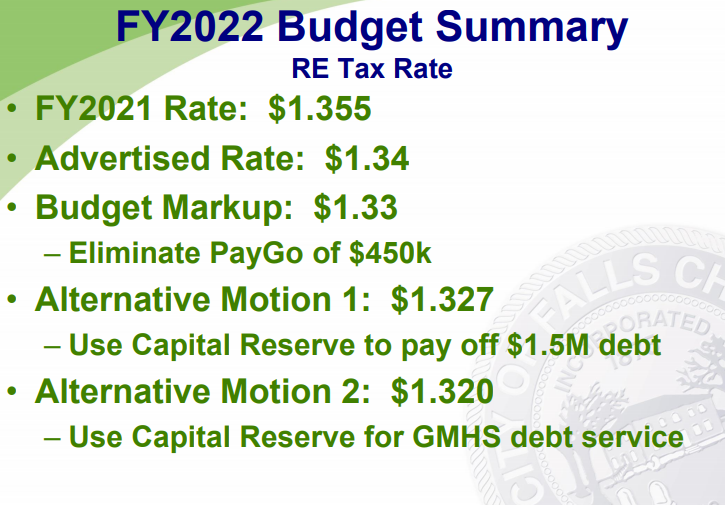

TL;DR: We unanimously voted 7-0 to lower the property tax rate 3.5 cents to $1.32 – the first time we’ve dropped it in over 15 years. We finished at 9 pm, which by itself might be a record. We also increased the stormwater rate by 2 percent to address increased investment in repairs and maintenance of the system.

Highlights:

- FY22 is the first city budget to surpass $100M

- FY22 is the first time we’ve allocated dedicated funding within the operating budget to affordable housing ($100K), enabling us to go after more grant funding

- Per the Use of Force Committee’s recommendations, FCCPD will adopt body cams this coming year, funded by a combination of grant and local funds.

- The budget fully funds the School Board’s requested increase of 2.5% growth from last year’s budget. The general government budget will grow 2.4%.

How we achieved the 3.5 cents reduction:

- This budget season, we’ve been diligently monitoring the recovering local economy and federal aid on the horizon while scrubbing the budget to return value to the taxpayers after, undoubtedly, a challenging year.

- The original budget by the City Manager included a 1 penny reduction to $1.345 due to higher than expected real estate assessments (which many of you received a few months ago), improving local tax performance projections, and new development.

- We further pushed the tax rate down to $1.34 at first reading by eliminating a COVID contingency fund, anticipating that federal relief funding will be available for that purpose. As I wrote last week, we then eliminated $450K of capital projects (sidewalks, traffic calming, facilities maintenance), with the plan to use federal relief money to restore those items later this year.

- The final penny reduction was achieved by using $1.8M in voluntary concession funding from the Founder’s Row development project to pay down part of the high school construction debt service.

Bottom line: for the median homeowner, instead of a tax bill increase of $350 had we kept the tax rate flat, the tax rate decrease means the median tax bill will be closer to $85. For the average commercial property, this means a 7% decrease or so in your tax bill – which I hope landlords will pass on as savings to their business and residential tenants. The increase in the stormwater rate will result in an approximate $5 increase for the average homeowner.

(2) Affordable Housing Forum

A recording for last weekend’s Affordable Housing Forum by the League of Women Voters and Citizens for a Better City is now available: https://youtu.be/xwa7iehLOC8

I was flattered to be considered an expert and invited to speak on the panel. We discussed the recent wins, and I shared my thoughts on a framework on five key areas for our housing strategies:

- Preserve the affordable housing we have already – it is more expensive for us to build new. While new units to be delivered in Founders Row and Broad and Washington will never expire, every affordable unit built in the city the past 20 years will expire unless we take action. Market rate affordable housing is also disappearing quickly due to rising prices.

- Keep building more units, both rental and ownership opportunities, and support increasing housing supply in general. This was echoed by others on the panel – that increased housing supply helps bring down prices across the board.

- Fund affordable housing – grants, developer contributions, dedicated funding from local budget, sustained revenue source like Alexandria’s meals tax 1%.

- Create and maintain more diverse housing stock – serve a broader spectrum of incomes, incrementalize into missing middle housing, incent preservation of smaller SFHs

- Keep tax rate in check and fund tax relief programs, because affordable housing should also mean “little a” affordable

What’s Coming Up:

Sunday May 2, 11am-2pm: 2021 Women’s History Walk

Current draft schedule of meetings and agenda items

City Council Meetings occur every Monday night at 730 pm, unless otherwise specified. You can access the agenda and livestream here, including recordings of past meetings