Updates from Letty – April 5, 2024 – budget edition #1

Blog posts are the personal views of Letty Hardi and not official statements or records on behalf of the Falls Church City Council

Dear Friends,

After a spring break recess, it’s now budget season!

We kicked off the week with the City Manager’s presentation of the FY25 Operating Budget and the Capital Improvement program (CIP). Over the next 6 weeks, City Council will meet weekly or more to dig into the details and listen to your input at town halls (our first one was last night), public hearings, and our office hours. Budgets should reflect the community’s values and priorities. While I think it’s important everyone is engaged year-round (the origins of this blog) – budget season is when it’s especially important to pay attention so we ensure our tax dollars reflect the community’s top priorities.

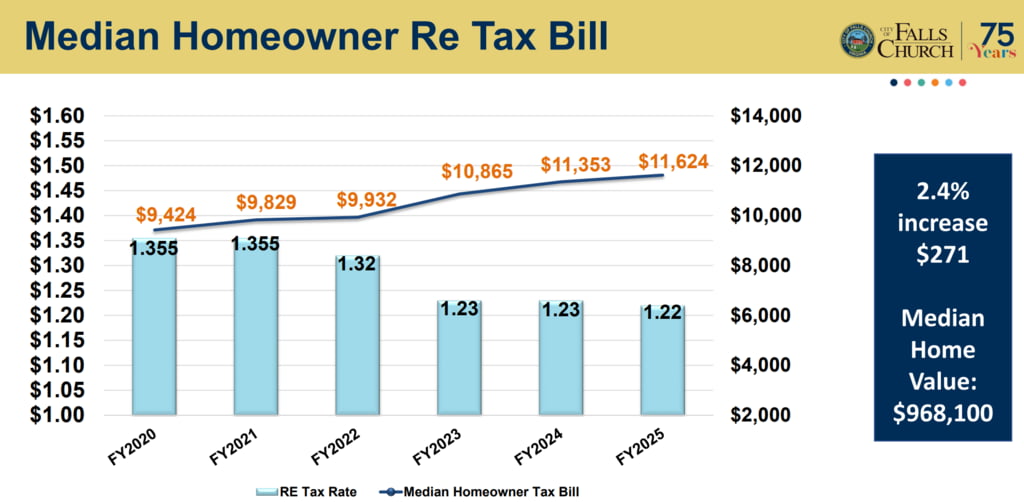

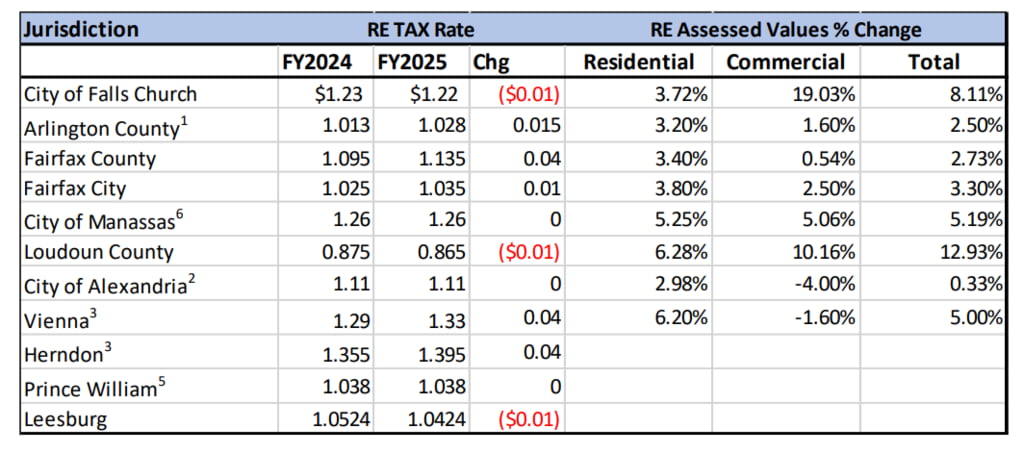

Read on for a digestible summary of what’s in this year’s budget. Besides the headline of a 1 penny real estate tax reduction (note: this is meaningful as nearly all of our neighbors are facing tax rate increases this year), I’ll share my initial thoughts on the budget, why we’re in this unique position, and the schedule ahead of budget adoption on May 13.

I look forward to hearing from you. Take note that I’ll hold my personal office hours next Friday, April 12 at 12 pm at the Broad St entrance of the Howard Herman Trail.

Best,

Letty

What Happened This Week:

FY25 Budget

Where can I find budget info? For all things budget, the City website has links to the operating budget, CIP, and public presentations. For quicker reads, the press release and the City Manager’s initial presentation are good summaries.

Whoa, that’s a lot of acronyms – I need a glossary and FAQs. Here you go!

Top FAQ – If you’re new to the budget process, the top FAQ I get is what is the difference between the operating budget and the Capital Improvements Program (CIP)? The operating budget generally funds the ongoing costs of government, while the capital budget funds one-time expenditures that cost more than $150K and have a useful life in excess of five years, that provide the community with an asset (new schools, playing fields, bridges, dump trucks, etc). More FAQs here.

When can I learn more and offer public comments? Read to the bottom of this post or go here. Note, we are scheduled to already take our first vote on the budget next Monday, April 8. Before you get alarmed that we just started the budget cycle, state law requires us to advertise tax rate ceilings, so that’s what we’ll be doing next week. Over the next 6 weeks, we can choose to adopt an even lower rate, but we can go no higher than next week’s advertised, ceiling rates.

What’s the TL;DR summary?

- For the median homeowner (home value of $968K) – the total tax impact will be about $299, derived from:

- Real estate tax* rate decrease of 1 penny (proposed $1.22 per $100 of assessed value). See here for tax rate history.

- No change to personal property tax rate (aka, car tax) as car values are finally started to normalize post-Covid/supply chain issues; utility fees will go up slightly to adjust for inflation.

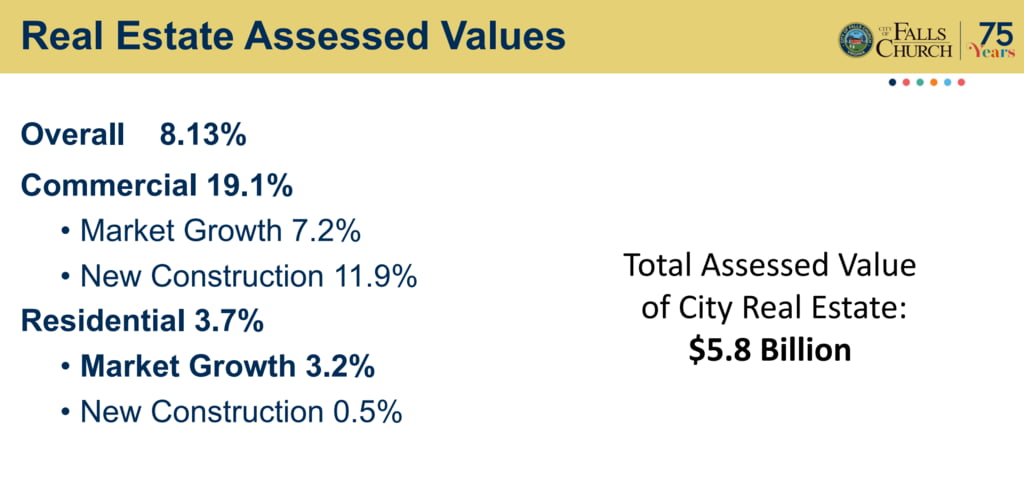

- Increased real estate values, 3.7% growth on residential and 19.1% growth on commercial. More on that below.

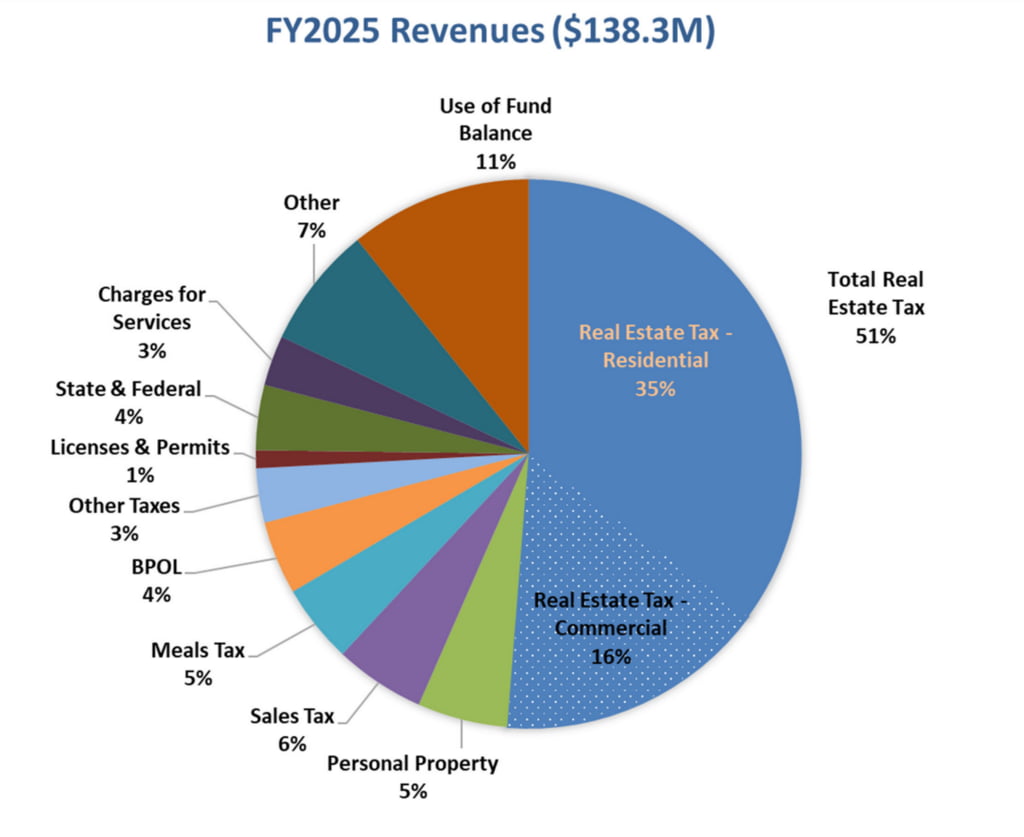

- The General Government’s operating budget is proposed to grow 7.9%, the budget transfer to FCCPS is proposed to grow 7.6%, with a total City budget of $138M.

- Theme of the City Manager’s budget: strengthening foundations for a growing city across infrastructure, key community priorities, and people.

- FCCPS and General Government budgets calls for comparable salary increases of 6% to invest in our workforce in a continued competitive environment, with increase in headcount of 23 total (16 FTEs in general government, 7 FTEs in FCCPS)

Real estate taxes – Real estate taxes make up just over 50% of the total revenues from the city, so it’s an important category to dive deeper! In other words, the real estate market dictates our budgetary fate and with the three large projects underway in the city, we’re seeing that positive impact. It’s notable that we’re expecting a nearly 9% growth in tax revenues because of a healthy local economy for both consumption-based taxes (sales tax, meals tax, hotel tax, etc) and commercial real estate taxes (19% overall growth, with 7% from market appreciation and 12% from new construction), whereas residential growth is more in line with the region at 3.7% overall. The commercial growth of 19% is notable because most of our neighboring jurisdictions are seeing flat or declining real estate values (and therefore taxes) due to commercial vacancy rates and stagnant return to office stats.

Also note that as we have diversified the tax base through development, the makeup of the residential vs commercial split between real estate taxes has changed over time. More on that another time.

Letty’s (Initial!) Thoughts:

We are very, very fortunate in Falls Church.

As most local governments started their budget process a few weeks ago, we have the benefit of seeing where their budgets are shaking out. Many, if not most, of our neighbors have the most painful budgets in recent history, with revenue growth barely beating inflation and are actually advertising tax rate increases as a result. It’s a perfect storm of increasing costs (salaries, cost of goods, Metro obligations) and declining tax revenue due to high office vacancy, and the end of federal pandemic stimulus.

Besides my long standing priorities like housing (which will see a more than 4x increase in funding), walkability, and pedestrian safety ($1.5M in funds + 3 new police officers who can help with traffic enforcement) where I’ll hone in most this budget season – it’s worth mentioning a new focus on governance that hasn’t been in previous City Council priorities. And that’s meaningful. I’m especially interested in areas of the budget that support modernizing and streamlining city processes and operations. Ultimately, investments in those areas pay off with more responsive customer service for residents and businesses, more efficient delivery of programs, and less manual processes and more fulfilling jobs for our workforce.

Additional things I’ll be focused on: as I first wrote about affordability over 8 years ago (!), affordability is not just about units of affordable or workforce housing, but ensuring that the tax burden is reasonable and we’re exercising strong fiscal discipline across operating and capital budgets. While the city is growing and there are needed investments in City infrastructure and people, I also believe it’s important that city budgets grow at a sustainable pace that keeps up with actual population or student growth and reflect key priorities of the community. Due to strong fiscal management and years of planning for the big capital projects we have now completed (new high school, library, and city hall), we have accumulated very healthy reserves to hedge against our high debt. As that debt exposure begins to subside, our reserves more than exceed our financial policies, so they should be reasonably deployed on generational and lasting improvements for the community, not to mention the federal and state grants over the past few years.

All in all, I am grateful that there is much good in this budget and appreciate the hard work from general government and school staff and colleagues that has gotten us to this point. Budgets are about balance, and I look forward to hearing from the community and working with my colleagues to ensure the budget balances our collective priorities.

What’s Coming Up:

Monday, April 8 – City Council Meeting – Budget Public Hearing #1*

Friday, April 12 – Letty’s Walking Office Hours (12 pm, Howard Herman Trail entrance on Broad St)

Monday, April 15 – City Council Meeting – Budget Work Session*

Wednesday, April 24 – Budget Town Hall #2 (12 pm, City Hall & virtual)

Monday, April 29 – City Council Meeting – Budget Public Hearing #2 & Work Session*

Wednesday, May 1 – City Council Office Hours (9 am, City Hall)

Monday, May 6 – City Council Meeting – Budget Markup*

Friday, May 10 – Letty’s Walking Office Hours (9 am, Cherry Hill Park)

Monday, May 13 – City Council Meeting – Budget Adoption*

*Mondays (except 5th Mondays and holidays) at 7:30 pm. You can access the agenda and livestream here, including recordings of past meetings