Updates from Letty – April 7, 2017 – Budget Edition #3

Blog posts are the personal views of Letty Hardi and not official statements or records on behalf of the Falls Church City Council

Dear Friends,

We are two weeks out from the final FY18 budget adoption on April 24th – the headline being the proposed 4 cents real estate tax rate increase (1 cent to fund the requested school budget, 3 cents for capital reserves). Thank you to those who have already written to us and attended the open house and town hall meetings. If you have input – continue to email or speak during public comment at Monday night’s meeting at 730 pm. Also, I’d love to hear from you at my office hours tomorrow – Saturday, April 8th at 9 am at Cafe Kindred.

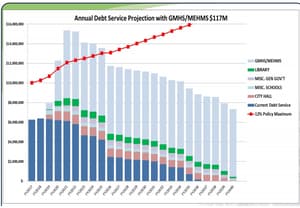

This week’s update is longer than usual and detailed. If you are new to the CIP – Capital Improvements Program, which was the focus of this week’s work session, I encourage you to spend some uninterrupted time to learn about it. In my opinion, the CIP receives less public attention during budget season compared to operating budgets, but the CIP is just as important. The 5 year CIP totals over $200M (including a placeholder amount of $60M-$117M for GMHS – which will be estimated to need 6-18 cents on the real estate tax rate to pay for annual debt service). Even without the high school project, the CIP is ambitious and includes the City Hall expansion ($17M – 2.5 cents), Mt. Daniel (originally $15M, now potentially $17-18M due to cost escalation), and Library ($8M – 1.5 cents). And like the rest of Northern Virginia, we can also expect dramatic increases to fund Metro – as much as 6 cents on the real estate tax rate in the next few years. More than ever, we need to figure out how to balance operating needs, capital projects, an affordable tax rate, and the risk of excessive debt. We have difficult choices ahead, and I’d value hearing your input on priority of projects in the CIP.

I’ll be traveling next week for spring break, so blog posts will be on spring break too and will resume on April 21st!

Happy Spring,

Letty

What Happened This Week:

(1) Budget Town Hall – if you missed the Town Hall last Sunday, the video is available. The budget book, work session documents, presentations are located here: http://fallschurchva.gov/1501/Budget-Capital-Projects

(2) City Council Work Session

CIP Discussion

“CIP 101”:

- CIP = a 5 year plan of proposed capital projects for long term improvements to City facilities.

- Capital project = new, one time project with a useful life of more than 5 years and costing $150K+; generally requires more significant engineering, design, and construction vs maintenance projects.

- On even numbered years, new projects can be added to the CIP – and this year, there are new projects proposed under IT, transportation, utilities, and parks. On odd numbered years, only minor updates generally occur to allow for staff focus on implementation.

- In the typical budget cycle, staff presents a proposed CIP (on a rolling 5 year basis), which will include projects across general government and schools, to the Planning Commission in January. The Planning Commission then evaluates the proposal in the context of the Comprehensive Plan. The Commission holds public hearing(s) to obtain community input and conducts several work sessions. The Planning Commission adopts their recommendations in late February, which is then presented as part of the Budget to the City Council.

- CIP projects are paid from three main categories or “funds” – General Fund (most projects – including schools, transportation, facilities, etc), Sanitary Sewer, and Stormwater.

- How is the CIP funded:

- Debt – the majority of the CIP is funded by general obligations bond, ie debt financed. The City is not required by state law to submit to public referendum the authority to issue general obligation bonds. However the City Council has established a policy that calls for public referendum for any project whose debt issuance exceeds 10% of the annual budget. You may recall that we also have a “12% policy” – that policy limit is that debt service (ie, interest + principal for bonds) should not exceed 12% of the total budget. Currently – across the 3 funds, we have $64M in outstanding bonds with $7.6M in annual debt service.

- Pay as you go / PAUG / Pay Go – a minority of projects are funded from cash – either current year’s revenues or from capital reserves. Currently, the Capital Reserve has a balance of approximately $9.8M – which is the remaining balance from the sale of the water system after the injection of $9.2M into the City pension plan.

- “Free money” – the one bit of good news is that City seeks grants and tries to maximize matching funds to make our local dollars go further, especially in the area of transportation. For example, $1 in local money can be used to bring in $4-10 in grant funds to improve the existing transportation network and add new multimodal options.

Highlights from FY18-FY22 CIP (this presentation is a good summary of recently completed and underway CIP projects)

- Voting equipment replacement – $250K (new) – replacement of the City’s voting system by 2020, by state law

- Larry Graves synthetic turf field – $1M (new) – conversion of the rectangular field to turf to allow greater usage and address low options for practice and playing fields

- Firing range shared with Fairfax City – $600K

- Mt Daniel – $17-18M (including additional $1-2M in debt to be issued if we approve request from School Board)

- City Hall – $17M, with $4M in debt already issued

- Library – $8.7M, with $1M requested this year for planning and design

- Facilities reinvestment – $200K to be used as “pay as you go” to maintain facilities

We spent most of the discussion wrestling with this depiction of the 5 year CIP – there are 16 projects currently active, 16 starting in FY18, and 19 projects starting in FY19-FY22. You can see that the majority of the projects occur in FY18 and FY19, prompting our discussion on the opportunity to reduce scope of projects and/or prioritize and phase projects further out to minimize the amount of risk and projects we take on within a short period of time.

This shows projected annual debt service with all of the projects in the CIP is it currently stands, with the red line reflecting the “12% policy” described above. We’re exploring ways to make the GMHS project more affordable (feasibility study on school options and economic development – both workstreams will be wrapped up in June), but I believe tough choices need to occur with the CIP.

Other topics:

We also heard a high level presentation from the Broad and Washington developers and an update on the Miller House. I’ll write more about those in future posts as they’ll likely come back in additional meetings. I would expect Broad and Washington project to be discussed in a more formal joint work session with the Planning Commission in the May/June timeframe once staff has had time for a more thorough review.

Materials and recorded video for both topics are online.

What’s Coming Up:

- TOMORROW – Saturday, April 8 – Letty’s Office Hours (9-10 am, Cafe Kindred)

- Monday, April 10 – City Council Meeting – Budget Hearing (730 pm) – topics include the budget amendment for additional cost for Mt. Daniel; Vision 2040; Budget Public Hearing

- Monday, April 17 – City Council Work Session – Budget Review (730 pm)

- Thursday, April 20 – Letty’s Office Hours (830-930 am, Rare Bird Coffee)

- Monday, April 24 – City Council Meeting – Budget Adoption (730 pm)

- Tuesday, April 25 – Community Workshop on Protecting Children from Sexual Abuse (630 pm)