Updates from Letty & Info Round Up #1 – October 27, 2017

Blog posts are the personal views of Letty Hardi and not official statements or records on behalf of the Falls Church City Council

Dear Friends,

This weekend, we’ll be ten days out from Election Day. If you’re overwhelmed, still trying to catch up from the summer (me!), or new to my blog – I’ve rounded up links to voter guides and videos of candidate forums so you can get informed about our local candidates. Next week, I’ll do the same with all the sources of information on the GMHS bond referendum. I have also added a few new FAQs as I continue to hear from the community. There is *a lot* of information out there that can be daunting even for the most engaged citizen, so I hope you’ll find it helpful to find it all in one spot. Do consider sharing this information with your friends and neighbors too (they can email me to get my on distribution list or like my Facebook page), and I’ll keep updating this post if I’ve missed any links.

The big City Council decision this week was our unanimous approval of the Miller House project. At any other time of year, this would have been a big deal but has flown under the radar given the community’s attention on GMHS. We also reviewed Q1 financial results, capital projects – yes, there are capital projects happening in the City besides school construction – and grant applications as creative ways to accomplish our priorities without burdening the tax base.

City Council meetings resume on November 13, so we’ll be on a brief hiatus for the next two weeks. My final office hours before Election Day is next Tuesday, October 31 at 9 am, Rare Bird Coffee. If you have topics or questions on your mind – I hope you’ll drop by.

Best,

Letty

What Happened This Week:

(1) Highlights from City Council Meeting:

Miller House

It was without much fanfare that City Council unanimously approved the agreement and land sale to construct the Miller House, which will be a small group home serving disabled adults at 366 N. Washington. The proposal involves the City selling the land for $1 with covenants restricting the use to group homes and a clawback provision should the group home operation end, which enables the operator to secure financing. As we think about housing needs across the region, I believe this was an important step in meeting an unmet need in our community on a vacant, underutilized parcel that was thoroughly evaluated to have no other use. Construction will begin next year, with a target opening of the Miller House in mid 2019.

Q1 Financials

Our CFO gave us an update on the Q1 2018 financials. TL;DR version: personal property tax and meal taxes continue to have strong growth but sales tax is behind the quarterly target. The major caveat is that the results are inconclusive as it’s too early to predict a trend. We’ll start planning the FY19 budget with “budget guidance” and other forecasts in a joint work session with the School Board in early December.

Quarterly CIP Review

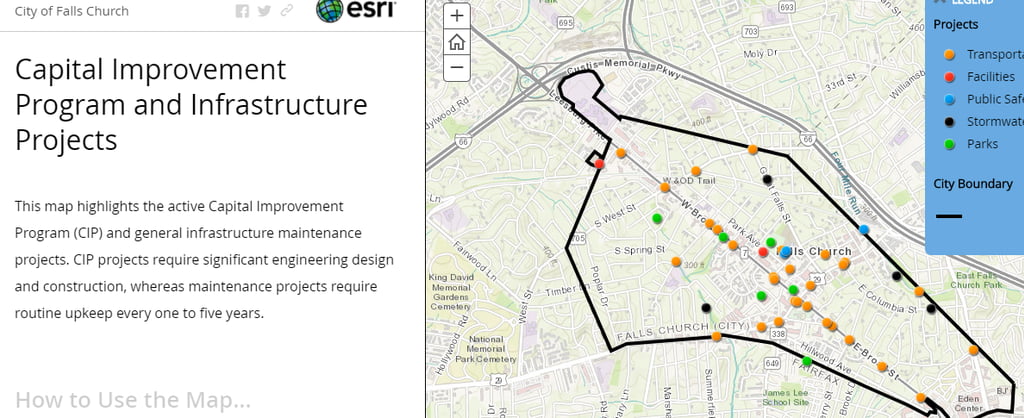

Want to know the status of Cherry Hill’s playground replacement? Or when Larry Graves turf field project will start? Or when we’ll improve traffic signal timing on Broad St? We had a quarterly check in on the long list of key capital improvements projects across the city. You’ll see that we have a lot of work underway, across parks, facilities, transportation, stormwater, and more where we are re-investing in important infrastructure. There is also a very cool, interactive map that visually shows you the projects across the City – check out what’s happening in your neighborhood.

Grants

Finally, we approved several resolutions endorsing grant applications for several projects – if the grants are secured, we’ll be able to get outside funding for projects like a pedestrian crossing across Haycock Road for safer access to MEH and GMHS, enhancements to Berman Park including better crossings at Ellison, Kent, Irving, and Spring, and W&OD dual trails which would pilot separate walking and biking paths on the W&OD through the city.

(2) New FAQs about GMHS Bond Referendum:

Letty’s previous FAQ post & Fact vs Fiction

Q: Is City Council taking out a $120M bond immediately if the referendum passes? Is this my only opportunity to chime in?

Letty’s A: No, the referendum authorizes the City to borrow up to $120M; we are not obligated to borrow that amount. Note there is a distinction between authorization and obligation. I have continued to be outspoken about finding tradeoffs to come below $120M without compromising educational outcomes; I believe there is a shared commitment across the School Board and City Council to do the same. Also, Virginia code provides that after a referendum, we have 8 years to issue bonds and 3 years to spend the money after issuance.

If the referendum passes, the project will proceed to the issuance of more detailed RFQ/RFP for the school construction and the economic development workstreams. While initial designs and feasibility work has been done, we will continue to seek public input on the detailed school design and economic development plans for the next 12-18 months. School construction would then start 2019, and when the high school is completed in 2021, that is when economic development construction begins. Note a key dependency: the majority of the school construction bonds would not be issued until there is a master developer agreement for the 10 acres of economic development (ie, school construction wouldn’t proceed) to minimize the risk that we would be footing the entire bill ourselves.

Q: I keep hearing about 1000 apartments! Will we be adding 1000 apartments to the GMHS campus site?

Letty’s A: We don’t know yet, and we (the City) will ultimately get to decide on the type of development if the referendum passes. Alvarez & Marsal, the real estate consultants who performed the valuation for the 10 acres of land studied what would be the “highest and best use” of the 10 acres to arrive at the $43-45M land transaction value. “Highest and best use” = what would generate the most value for us + what the market would support. Similar to past studies, they believe there would be strong interest for 10 acres of land adjacent to Metro and inside the Beltway. The basis of the valuation study is a 70/30 mix of residential and commercial that includes 816 apartments and 148 age restricted 55+ housing units (see page 7 of their full study).

If the referendum passes and we proceed with economic development on the 10 acres – like the school construction process, an RFP will be issued to solicit formal bids for economic development. If we received all commercial responses, like anywhere in the city, of course those proposals would be considered thoroughly. Personally, I believe we will have some housing and mixed used development. However, I believe apartments have unfairly gotten a bad rap – they have brought an important component of much needed housing and demographic diversity to the City. And again, mixed use development with apartments in the past 15 years have generated positive returns that more than offset the service costs, brought amenities to Falls Church, and revitalized under-utilized parcels of land.

Q: Why does my tax rate keep going up if economic development has been so successful?

Letty’s A: While no one disputes that our tax rate is higher than our neighbors’, it’s a common misunderstanding that we are raising them all the time. The largest jump in tax rate was between 2009 and 2013 when it went from $1.07 to $1.305 per $100 in assessed value. It was mainly due to the recession and the sale of the water system. Over the past 4 years, the tax rate has been rather flat – 1 penny increase for operating expense growth and 1.5 cents we voted for this past spring to directly fund reserves for the GMHS project; that rate of growth has been comparable to our neighbors. We are now at $1.33 per $100 in assessed value.

Vice Mayor Marybeth Connelly also has addressed this question recently in her blog post with details on budget decisions in the past 4 years.

As for economic development – that’s the reason why we’ve been able to keep the tax rate mostly level for operating budgets. Without new businesses and new mixed use development, our tax rate would be 7+ pennies higher than it currently is – i.e., closer to $1.40+ per $100 in assessed value. I wrote about this in more detail with a lot of backup data in a FAQ blog post I wrote awhile back:

www.lettyhardi.org/faqs-about-the-tax-rate-and-economic-development/

(3) Election 2017 – Info Round Up #1

Sample Ballot, In Person Absentee Voting, Election Day information: https://www.fallschurchva.gov/135/Voter-Registration-Elections

Voter Guides on Local Candidates:

- League of Women Voters Vote 411 Voter Guide: http://www.vote411.org/

- VPIS Candidate Questionnaire: http://www.vpis.org/files/VPIS_Questionnaire_Booklet_2017_1012.pdf

- Falls Church News Press Candidate Statements:

Candidate Forums

- Community Issues Forum City Council Candidate Forum (Community Issues Forum Host): https://www.youtube.com/watch?v=RqaKjsdjG3w

- School Board Candidate Forum (League of Women Voters & VPIS Host): https://www.youtube.com/watch?v=7RedrRM6YwI&feature=youtu.be

What’s Coming Up:

- In Person Absentee Voting is underway at City Hall! Weekdays 8 a.m. – 5 p.m. and Saturday, October 28 & Saturday, November 4 – 9 a.m. – 5 p.m. (November 4th is the last day to vote in person absentee).) There are many reasons why you could qualify to vote in person absentee, so take a look and see if you qualify.

- Tuesday, October 31 at 9 am – Letty’s Office Hours (Rare Bird)

- Tuesday, November 7 – Election Day

- Monday, November 13 at 730 pm – City Council Meeting