Updates from Letty – June 23, 2017

Blog posts are the personal views of Letty Hardi and not official statements or records on behalf of the Falls Church City Council

Dear Friends,

Happy summer! While the kids are now out of school, we’ve been putting on our thinking caps. As expected, we had a meaty work session this week, with our first discussion on draft GMHS referendum language for the November ballot. We also considered a proposal to push out projects in the CIP in order to accommodate the cost of a new high school and another look at financing and impacts to the tax rate. Both items are on Monday’s schedule for a first reading vote, with the final votes at the end of July in order to proceed with a November referendum.

The idea of deferring projects that all have merit on their own is never easy. These are tough but necessary discussions. Like the annual budget work, I view prioritization as a key function of the City Council where we have to look at the entire City’s needs in the short and long term, plan how to best achieve our vision, and stay true to our values. This is likely to be a lengthy email/blog post, so I encourage you to set aside time to read, click through links, and send us your questions and thoughts – citizen input is more than welcome as we grapple with these tough decisions.

Best,

Letty

PS – Due to water damage on the video equipment in City Hall, the video of Monday’s meeting and some of the presentations are taking longer than normal to upload. Check back here soon.

What Happened This Week:

(1) GMHS Campus Updates

Economic Working Group

- Initial valuation of 10 acres from the market study was shared with the economic working group last week. It assumes a 70% residential/30% commercial mix and density of 3.0 FAR (floor area ratio) which was the Urban Land Institute study a few years ago. (For comparison, that density is comparable to other mixed use development we’ve seen in the city. 30% commercial mix is higher than what we’ve seen built to date.) The initial valuation estimate for a land transaction (either a sale or a long term ground lease) is $43M.

- I emphasize “initial estimate” for two reasons – the valuation work is a process and we’ll get additional values based on different mix of uses (ie, more or less residential, different kinds of commercial uses, etc). Ultimately, the final uses will drive the value of the land transaction and future tax revenues. The City plays a key role in determining the kind of development we’d like to see there in conjunction with market forces.

Campus Working Group – The school feasibility workstream is wrapping up. Dr. Noonan reported that now that the preferred design option was chosen by the School Board (the “Community School” – a one phase construction, $120M new school that makes 10 acres available for development), the next step is a conceptual floor plan. Again, all of these designs are conceptual and likely differ from the final one for actual construction. If approved to go on the ballot, the next phase in the procurement process would be a RFQ (request for qualifications) for a broad number of school architecture firms. If the bond referendum passes in November, we’ll then issue a RFP where we’ll solicit actual designs and bids.

School construction costs & district wide planning

- As part of the agenda from this week, Dr. Noonan provided us a detailed memo that includes a history of the GMHS project to date, levers to decrease the cost of the project, and a look at capacity and future school expansion needs at TJ and MEH.

- Where did the $120M cost come from? The Perkins Eastman estimate for a concept like the Community School was $123M. With $6.5M in potential reductions (see memo) the School Board would make, the school construction cost could be reduced to $117.5M. After adding in financing costs, the total construction cost would be $120M, which is the number in the draft referendum language and used in financial modeling the CIP.

- Also included in the memo is a look at enrollment projections vs capacity at all of the FCCPS schools, which is so important when we look at the entire City’s CIP and how we might re-align projects. From the memo and Monday discussion – with the assumption that 2nd grade temporarily moves to Mt. Daniel, a TJ addition will be needed by 2021 or sooner and is estimated to cost $10-15M, followed by a separate MEH expansion need in 2025. These dates may seem like we’re years away, but even if the high school project passes referendum and stays on schedule, bonds could be issued as early as next year and a new building would open in 2021. My takeaway is that even after Mt. Daniel’s construction gets underway this summer and GMHS could be on a referendum in November, we won’t be done. We will have additional school construction needs for many years to come, which is a common challenge across our entire region.

Geothermal presentation – we also heard a presentation about the feasibility of geothermal technology and other energy efficient measures for GMHS. (The presentation will available when the video is uploaded.) The main takeaway is that there is an initial investment vs traditional HVAC system, but with technology improving every year, the payback period is now shorter – only about 4 years – where we’ll see lower energy and maintenance costs. that offsets the initial premium.

(2) Referendum Language

Instead of linking the old version of the referendum language that we looked at during work session – here is the draft ordinance we’ll be looking this coming Monday with edits based on our discussion. One of the lessons learned from Mt. Daniel is the importance of flexibility in the bond language. However, between state code requirements and my belief that we also need to be specific enough that voters need to know what they’re voting for and not a “blank check” for any project, the language can’t be too vague.

Also two important points – bond referendums authorizes the City to issue the bonds up to the maximum amount, but does not obligate the City to issue any or all of the bonds. Also, once passed -per state code, we have 8 years to issue the bond and 3 years to spend the money after issuance.

(3) CIP Amendments & Tax Rate Impact

Due to the extraordinary expense of the $120M high school, the City Manager asked us to put on our “fiduciary hats” as stewards of the City’s finances and take a hard look at the 5 year CIP. Unfortunately, the presentation is not yet available online, so I snapped a few photos of the key slides.

This is also a good time to revisit a blog post from December that I wrote to make the question of affordability and financing for the high school easier to understand. $120M is a big lift for the city – it requires creative financing, a huge reliance on using reserves (especially reserves bolstered by $40M from a transaction for the 10 acres for commercial development) in order to make the tax rate increases palatable, and really limits our ability to fund future capital needs.

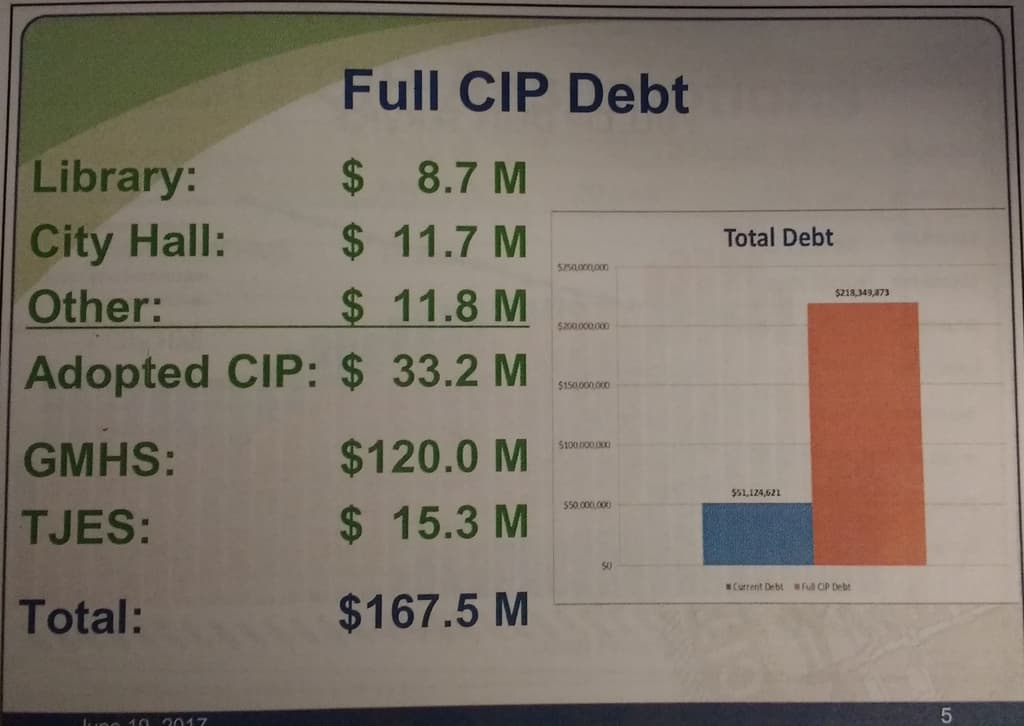

As it stands now – we have $51M in city debt. If we were to add the full CIP that includes projects like the Library, City Hall, land acquisition for parks, TJ expansion, Larry Graves field, it would more than quadruple our total debt to $218M.

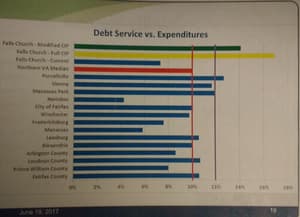

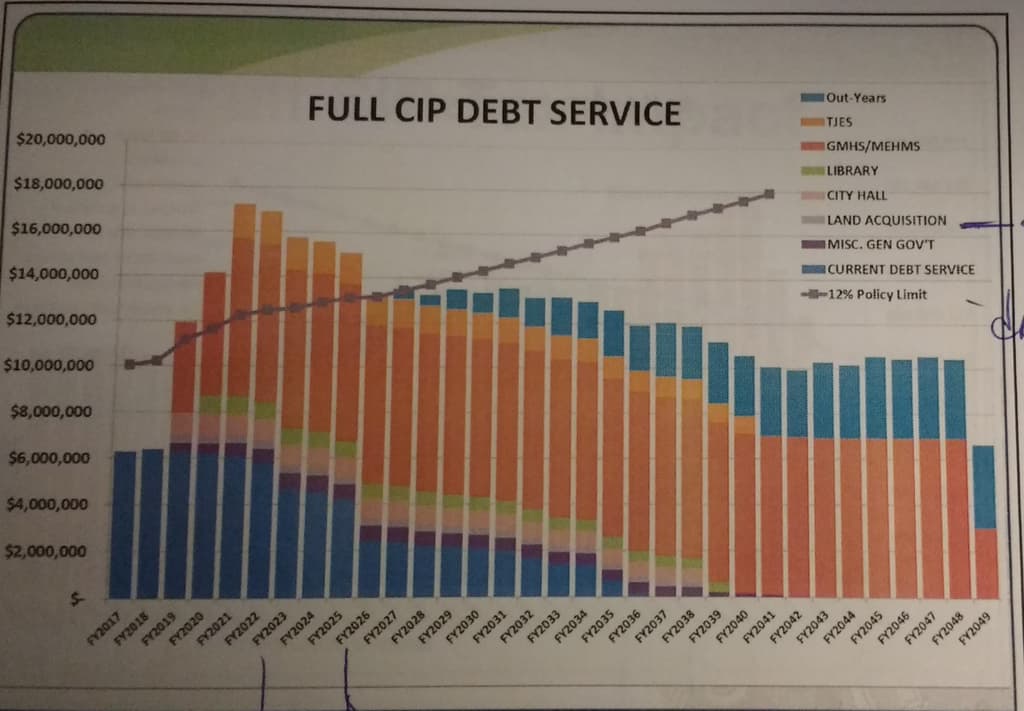

While the total debt number is a bit scary, the debt service (ie, interest + principal on the bonds) that we have to pay each year would break financial policy. We have a policy that states debt service should not exceed 12% of expenditures and we would be out of policy for 7 years if we were to take on the debt of the full CIP. This is important because not only would we need to raise a lot of pennies on the tax rate to the pay for the debt service, but our annual budgets would be even tighter than normal because over 17% of our annual operating budget would need to go towards debt service (as comparison, debt service makes up 8% of the budget currently)

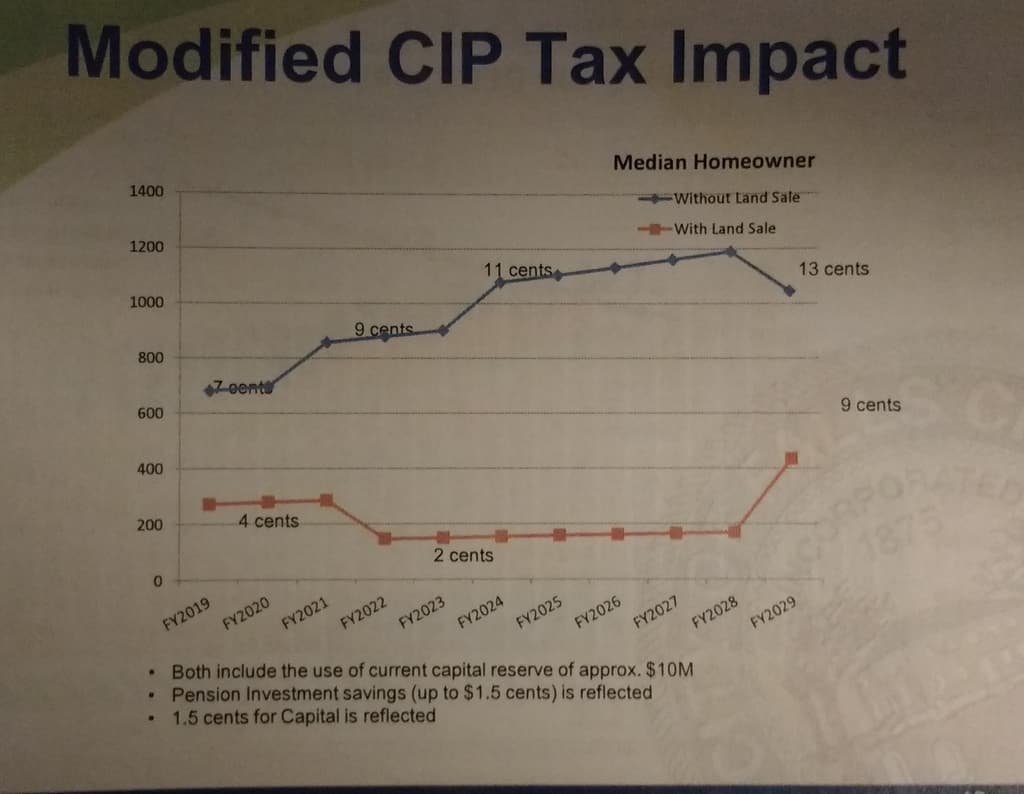

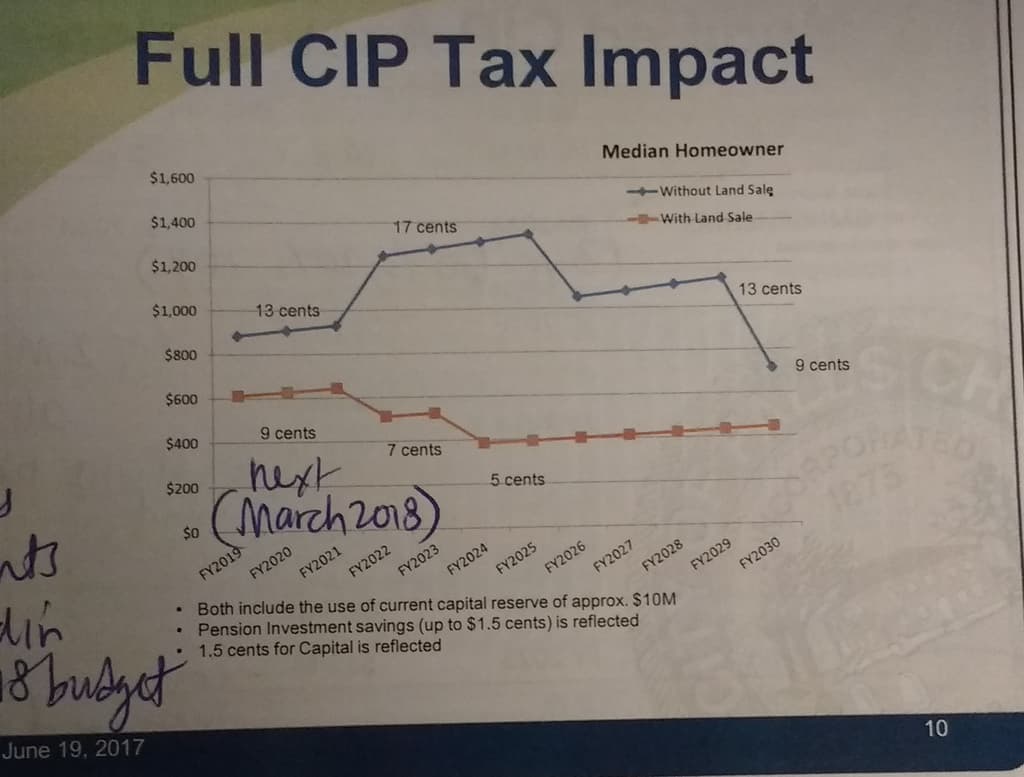

Assuming we use the same financing levers I wrote about in December (30 year vs 20 year term on the bond, level debt vs level principal payments, use of reserves to pay debt service) and the other assumptions come true, this is the initial look at the tax rate impact if we were to take on the full CIP. For the median homeowner, the tax rate would increase about 13 cents increase if there were no land transaction and 9 cents if there were, starting March 2018 and then going up or down depending on which version. The difference in the blue and orange lines shows the importance of the commercial land. Likewise, it also shows the risk of taking on the full CIP with the assumption we’d get $40M for the land, and the impact if the land transaction were to not happen or be delayed.

Next we looked at the modified CIP in order to mitigate the tax rate impact, the debt to expenditure policy we’d be breaking, and decrease the risk and reliance on the land sale proceeds. In the version of the modified CIP, all new projects except City Hall and GMHS would be pushed out to align with when we’d expect to receive land proceeds and when debt service from various past projects come off the books – with the largest decrease in 2025. The downsides are that all of those projects have rationale why they should be done sooner than 2025 and we can almost bet that those projects will cost more in 8 years. On the plus side, the tax rate impact is much more moderate – from 4 cents assuming a land transaction and 7 cents without.

Note that these tax rate figures are a little lower than we talked about in the winter – for two reasons: in the recently passed FY18 budget, we increased property taxes 1.5 cents to start funding reserves. Also, the pension investment from the water sale proceeds is generating another 1.5 cents. So had those two decisions not been in place, all of these tax rate figures would be 3 cents higher than otherwise.

To wrap up, it’s important to note that even with a modified CIP, we would still be exceeding regional averages and our own policy on several key metrics – debt service to expenditures, debt services to assessed value, and debt per capita – and could impact our credit ratings. It again illustrates the significant amount of risk we’d be taking on.

(4) City Hall Update

For brevity’s sake, I won’t give a lengthy update on the City Hall project. Staff presented us an update on options to do the bare minimum system replacements, safety and security renovations vs the current $13M proposal.

What’s Coming Up

- Monday June 26 – City Council Regular Meeting (730 pm, City Hall chambers) – the biggies will be the first reading votes on the bond referendum ordinance and modified vs full CIP topics from above. Like the budget, financial numbers can decrease between first and second readings, but not increase without needing a new first reading.

- Friday, June 30, Campus Economic Working Group Meeting (730 am, Dogwood)

- Monday, July 10 – City Council Regular Meeting

- Monday, July 17 – City Council Work Session

- Monday, July 24 – City Council Regular Meeting – **final City Council vote for referendum language & CIP Amendment**