Updates from Letty – March 12, 2021 – Budget Edition #1

Blog posts are the personal views of Letty Hardi and not official statements or records on behalf of the Falls Church City Council

Dear Friends,

A year ago was such a scary, surreal time that it’s hard to believe we’ve reached this anniversary. It’s been a heavy reminder of the lives lost and a year we’ll never get back. I hope this week’s warm weather and continued good vaccine news have created space for hope and that we continue to see brighter days ahead.

This week marked another milestone with the beginning of the annual budget process. Priorities are only meaningful when we allocate dollars against them, so this is one of the most important jobs we have. With rising real estate assessments and recognition of hardships in many households – the proposed budget currently reflects a 1 penny tax rate decrease. Read on to understand how that’s possible, an overview of the proposed budget, and some of the new investments in this year’s budget that I’m excited to see reflect our evolving priorities as a city.

My office hours have been on hiatus for the past year, and I’m currently planning to resume them in April, outdoors and masked – dates and times to come. I’m happy to keep hearing your questions and comments over email or you can speak to us live in our virtual meetings on Monday nights.

Take care,

Letty

What Happened This Week:

(1) FY22 Budget

The entire budget book and the presentation are both available, but here are the highlights for the FY22 budget. In the next 2 months, we’ll be diving deeper into various areas of the budget and I’ll share more.

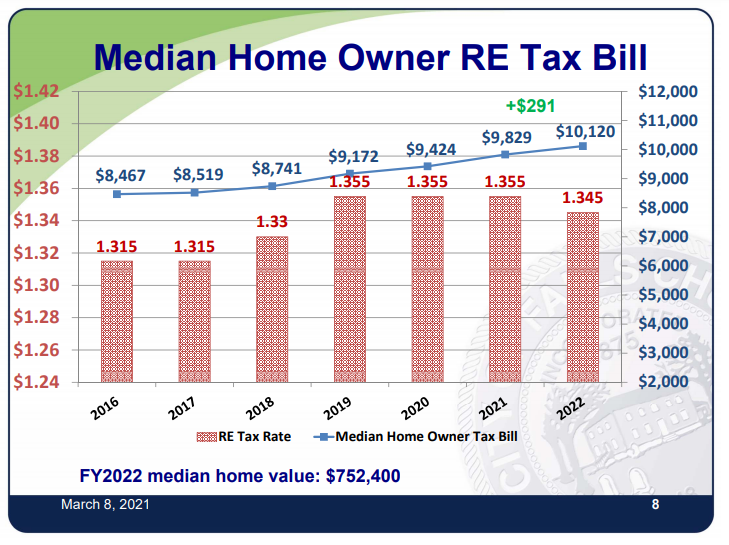

- Headline: City Manager has proposed a 1 penny real estate tax rate decrease.

- Your bottom line: If the proposed budget is adopted, the average homeowner’s tax bill will increase by $291 because of higher property assessments. Your stormwater fee will increase about $5 due to a small rate increase.

- Assessments are up: If you noticed that your neighborhood real estate market has been booming, you’re not the only one. Residential property values have increased in spite of the pandemic and new commercial development has contributed nearly 60% of the total assessed value increase. The value of commercial real estate has decreased due to COVID impacts on the office market across the region – so the fact that we have new construction coming online (eg, Founders Row) lifting overall commercial real estate assessments is important.

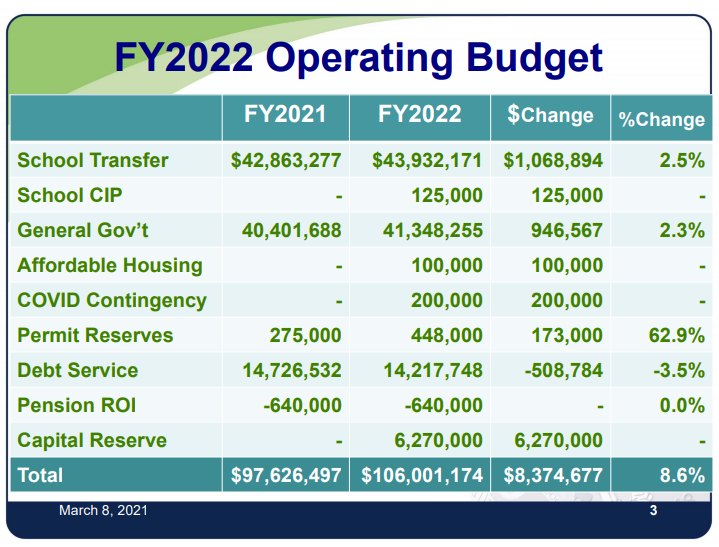

- First $100M+ budget: If it weren’t for COVID, FY21 was supposed to be the year our revenues topped $100M. FY22 may be the year instead. The school budget and general government budgets are each growing by about 2.5% and 2.3%, respectively, per our budget guidance.

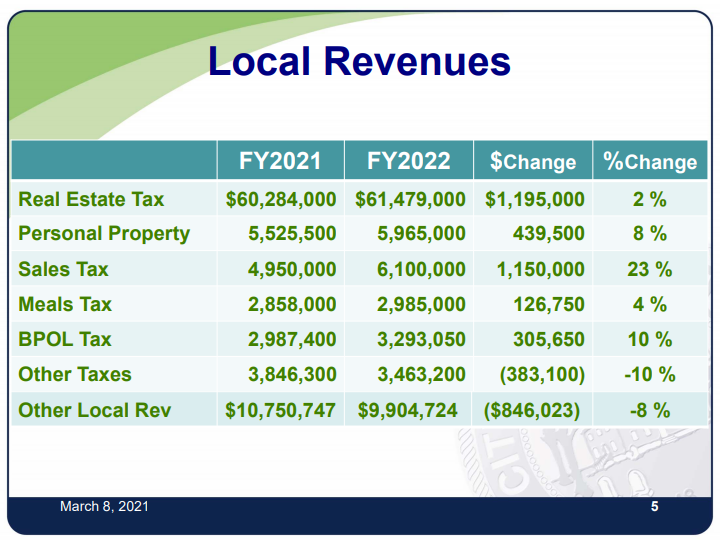

- Keep spending locally: Note a strong rebound in many areas of local revenues is expected – continuing the trend that online and grocery sales have driven sales tax growth, even during 2020. While this is very much a recovery budget, also note some areas of the economy (eg hotel) are not yet bouncing back.

- Wildcard: with the passage of the American Rescue Plan this week – besides relief to many households and a sigh of relief for Metro, we expect federal aid to local governments for infrastructure projects. Details, like how much money and when we’ll see it, are not yet known, so the challenge will be pass a budget that responsibly balances local dollars on key priorities with not-yet-known federal aid.

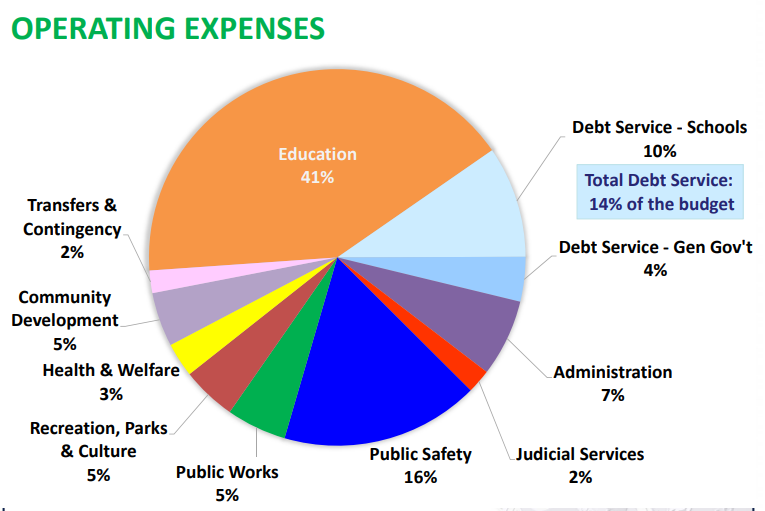

- FCCPS Budget: per our charters, the City Manager has to incorporate the School Board’s budget as is, with no modifications. I’ve been grateful that we’ve had “easier” budget cycles the past few years, with the school’s budget coming in at guidance the past 3 years, recognizing the extraordinary lift in undertaking the financing of the new high school. While City Council has no line item authority on the school budget, we will have a work session on March 22 to discuss school-specific items, as we spend the majority of our operating budget on education (41% of total expenses for operations and 10% for school debt service).

- Specific new investments to watch:

- $100K in the affordable housing fund, something we’ve never done in an operating budget before

- $100K for annual sidewalk program (in addition to $100K for traffic calming that’s been in the budget for a few cycles now) – reflecting two top priorities we’ve heard from citizens

- Increase in funds for Rec and Parks needs-based scholarships and for senior tax relief program

- Police body cams, per Use of Force Review Committee recommendation – partially funded with grant money

- Resources to enable use of automated speed enforcement in school zones

(2) Spring Fitness Challenge

The City will be competing against the City of Fairfax and the Town of Vienna in fitness challenge during April-May. Help us determine which jurisdiction is most fit by tracking the number of minutes you exercise each week! Open to everyone (and free t-shirt alert). Sign up through the Rec and Parks registration system and you can also follow along on the Facebook event page. If you have any registration issues, you can email events@fallschurchva.gov.

What’s Coming Up:

Current draft schedule of meetings and agenda items

City Council Meetings start at 730 pm, unless otherwise specified. You can access the agenda and livestream here, including recordings of past meetings