Updates from Letty – March 31, 2023 (Budget Edition #1)

Blog posts are the personal views of Letty Hardi and not official statements or records on behalf of the Falls Church City Council

Dear Friends,

The City Manager presented his proposed FY24 operating budget (FY24 starts July 1, 2023) and the CIP (Capital Improvements Program) this week, which marks the beginning of City Council’s annual budget season. The budget is one of the most important decisions we make each year, as it should reflect our community’s values and priorities. Aside from our work plan, the budget is the main vehicle to initiate change.

I’ll share some budget 101 if you’re new to this or would benefit from a refresher, highlights of the proposed budget, and what you can expect in the 6 weeks ahead of final budget adoption on May 8.

I look forward to hearing from you.

Best,

Letty

What Happened This Week:

(1) FY24 Budget & CIP

Budget 101

What’s the difference between the budget and CIP? The operating budget generally funds the annual costs of government (mainly personnel) – everything from schools, public works, police, transportation, library, parks. The CIP (capital improvements program) funds one time projects that provide a new asset, which is defined as having a useful life of more than five years and costing $150K or more. The CIP is developed on a rolling 6 year basis (plus a full 10 year outlook which I had advocated for to ensure we were doing sufficient long range planning). In recent years, our CIP has been dominated by new or updated civic buildings (new high school, library, city hall) funded by debt and a lot of transportation and stormwater infrastructure projects funded by a combination of grant and local dollars.

Also note that we’ve adopted a tradition where odd year CIP allows for primarily updates and even year CIP allows us to add new projects. FY24 is an even year CIP, so we’ll have the opportunity to add new capital projects.

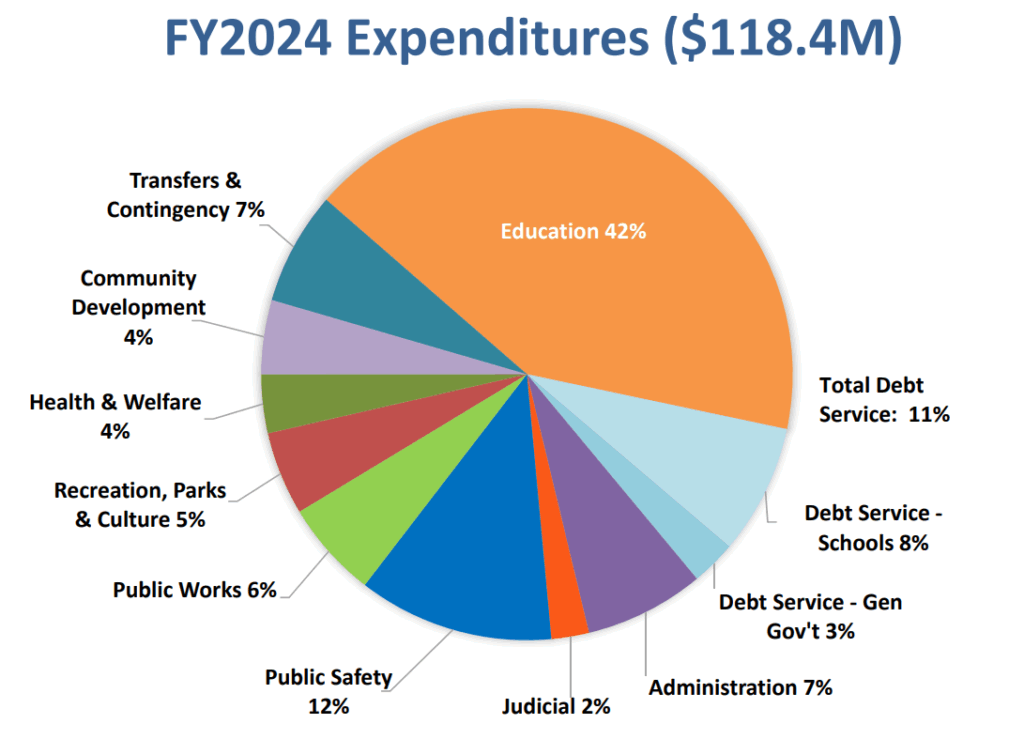

Who does what? By charter, the School Board independently adopts their budget (following the presentation of the budget by the Superintendent and a series of work sessions and public meetings from January through February). The City Manager is required to fold in the School Board’s requested budget as is, ie with no changes. For specifics on the schools’ budget, I encourage you to check out the FCCPS Budget website. As proposed, the budget amount requested by the schools is about 42% of the City’s annual expenses (about $49M).

A quick blast from the past that is important context: since 2019 with the FY20 budget (so now, 4 years running) we’ve had more “peace in the valley” with school and general government budget requests in contrast to earlier years due a confluence of factors: the shared goal of taking on a huge capital project with the new high school, an informal revenue sharing agreement with the general government and schools where we agree to split organic revenue growth 50/50, flat/decreasing school enrollment, and strong revenues and economic development despite weathering a global pandemic. Here’s my 2019 blog post as a refresher.

For the CIP, the development of the CIP starts with City Hall departments requests for immediate and long range capital needs, which is then presented to the Planning Commission. The Planning Commission evaluates the CIP in the context of the Comprehensive Plan and community priorities, holds their own hearings, and those recommendations are included in the City Manager’s proposed budget.

The City Manager develops the budget, in accordance to department needs, the City Council’s adopted 2 year work plan, and priorities within the “budget guidance” which we issue every December. As you may recall, our guidance this year directed the City Manager and Schools to develop budgets that “should strive to be within organic tax revenue growth” which was projected to be 4.2% growth over last year’s budget – in laypeople’s terms, that means without increasing or decreasing the tax rate. As noted above, the schools’ budget request meets budget guidance and does not request more than organic revenue growth, ie does not require an increase in the tax rate.

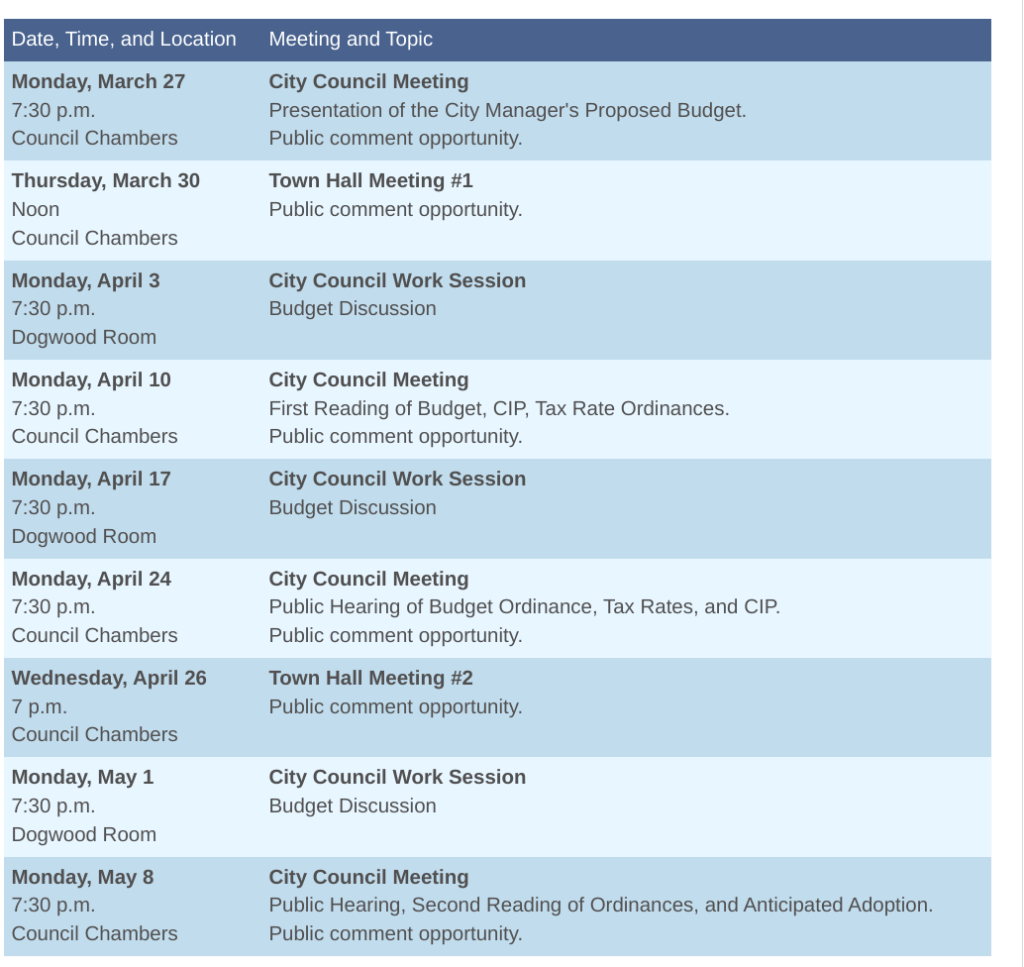

After the City Council hears the proposed budgets from the City Manager (and Superintendent/School Board), we hold a series of work sessions, public hearings, and town halls from March to May to collect input before adoption 6 weeks later, this year on May 8. The fiscal year later begins on July 1. Note: most attention during the budget process is on the General Fund, which funds the majority of city operations, but the budget also includes the Sanitary Sewer Fund and Stormwater Fund which are under our purview.)

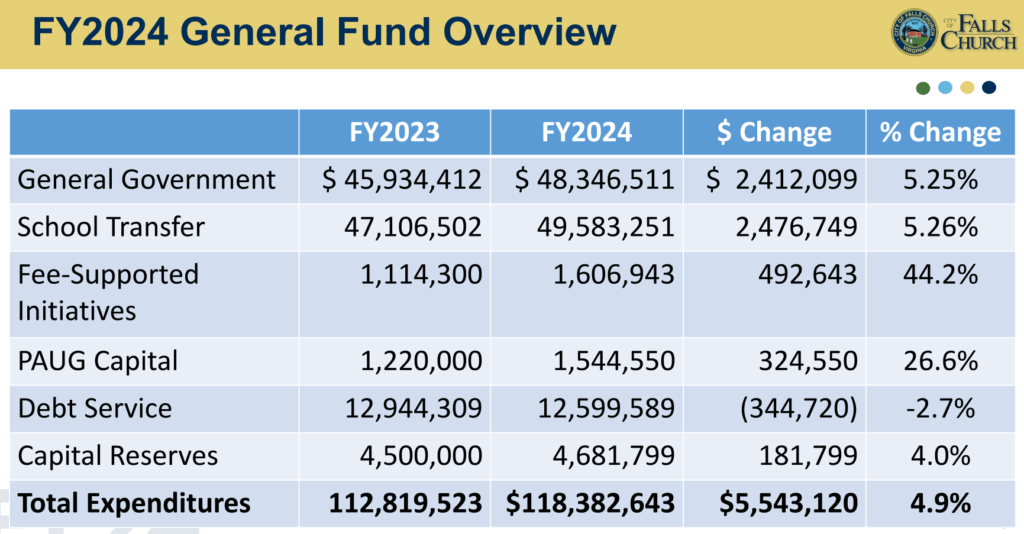

What is the size of this year’s budget? Unlike the federal government, our local operating budget has to be balanced – we can only spend the revenues we bring in. The FY24 budget is about $118M, a 4.9% increase over last year’s budget. The general government and schools’ budgets each are growing a little over 5% and debt service – following the peak a few years ago when we took on $116M in debt to fund the new high school and library – is slowly declining and we’re back below our debt service policy limits.

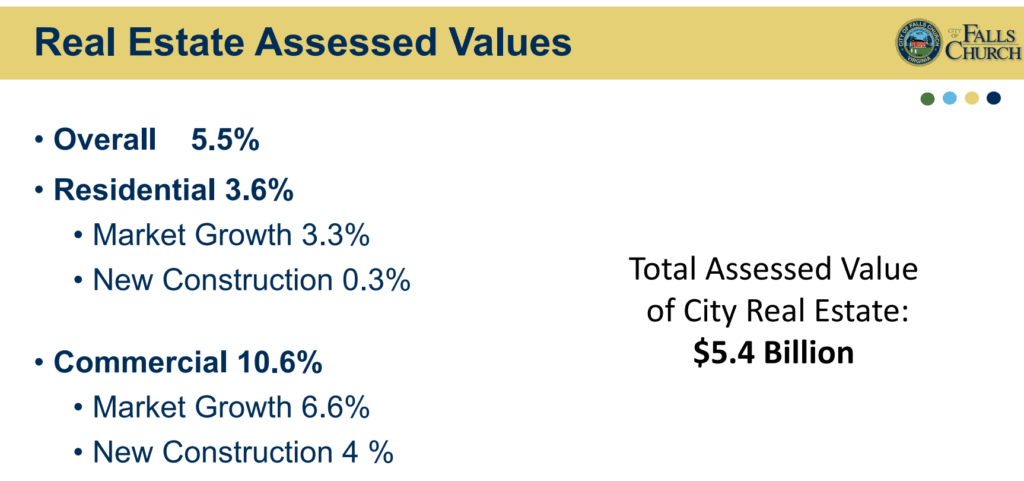

If you’re following closely – as I noted above – in December, organic revenue was projected to be 4.2% whereas total budgets are growing 4.9%. So where is the extra revenue coming from? This spring, we saw commercial assessments come in higher which provided another $1M in revenues that are proposed to be used by the City Manager.

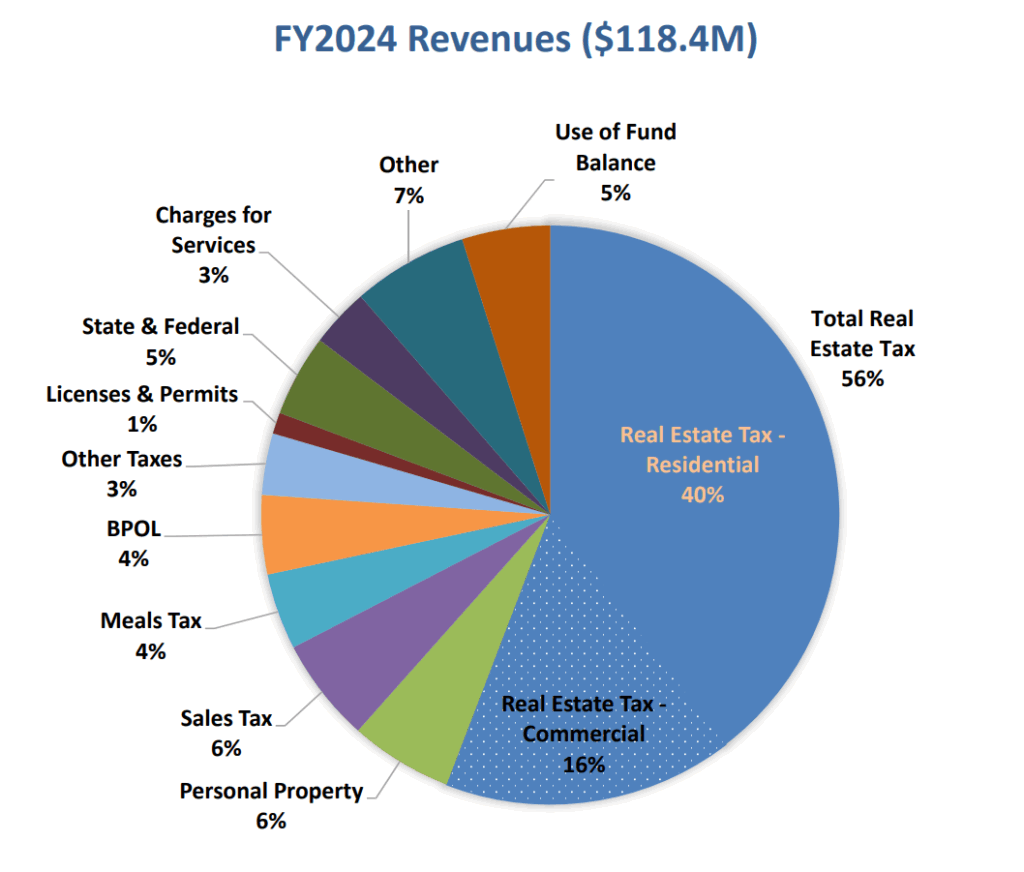

Note that a majority of the revenues come from real estate (56%), with residential making up 40% and commercial making up 16%. Local taxes like sales, meals, and business taxes make up 14% which is also a sizable portion of our revenues (a good plug to #livelocal).

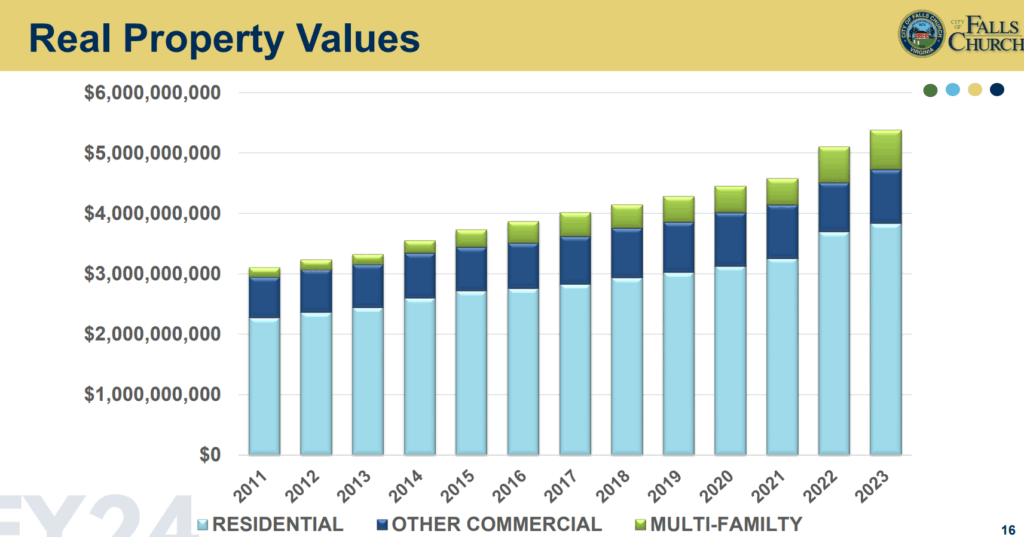

It’s also worth noting that over the past 10 years with economic development, we have clearly diversified the tax base where commercial and multifamily buildings have contributed to a much larger share of the tax base (green and dark blue parts of the stacked bars below).

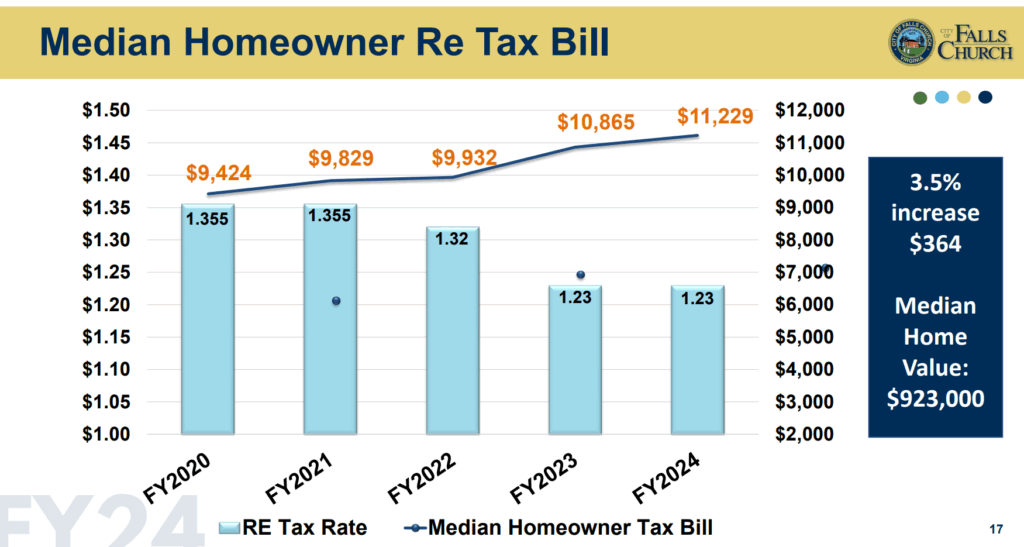

Tax rates x assessed values = tax bill The City Council is responsible for setting all the tax rates, and the one that gets the most attention is the real estate property tax rate. We also set the tax rate for personal property like vehicles, gross receipts business taxes, and utility taxes like stormwater and sewer. On real estate, we have decreased the tax rate by 12.5 cents over the past two years to $1.23 per $100 in assessed value (we had increased it a total of 4 cents from 2016-2019 in preparation for the big capital expenses like the new high school). As proposed, the City Manager’s budget keeps the real estate tax rate flat. This is a good history of the tax rate.

In contrast to the tax rate, real estate assessed values are independently determined by the real estate assessor’s office, which by law has to represent full and fair market value as of January 1 of that year. City Council has no role in determining the value of your house or property. If you have questions or concerns about your assessment, the first deadline to file an appeal is April 17. More info here. Car values are also independently assessed, usually based on third party sources. (We all experienced the anomalous market in the past year, where we saw used car values spike due to the pandemic and supply chain disruptions. As a result, we had decreased the vehicle property tax rate by 70 cents last year to offset the jump in value.)

In contrast to other jurisdictions where commercial real estate is struggling, we actually saw commercial values outpace residential here due to a combination of new development and market growth, with overall AV increasing by 5.5%.

What’s next and where can I find more information? The budget website includes links to the full budget book (warning: it’s 300+ pages,) the CIP binder and lists all of the upcoming meetings and will include recordings as they occur if you want to catch them later. The City Manager’s presentation and the press release are good cliff notes versions of the budget.

Two key votes: on April 10, we vote on the first reading of the budget and advertisement of the tax rates. The rate that the City Council chooses to advertise becomes the ceiling for the Council during the budget process. We can adopt a lower rate, but we can go no higher. On May 8, we adopt the final budget and CIP. See below schedule for work sessions, public hearings, town halls where you can follow along and provide your input.

Highlights from this year’s budget

- A key priority for the general government budget this year is investing in our workforce – between the city’s high vacancy rate, competing in a super competitive job market, and goal to achieve competitive compensation based on the compensation study last year, employee compensation represents a large portion of the new spending. The FY24 budget calls for a 6% merit increase and the equivalent COLA and step increase for police, plus additional funds for professional development.

- Other priorities funded: affordable housing, especially deeply affordable housing like 30-40% AMI (area median income), 2 hours increase in library hours, continued investments in transportation such as sidewalks and fully funding the rapid response crew to address pedestrian and bike safety concerns, park development at Fellows Property, additional School Resource Officer, photo camera enforcement for speed and red light violations.

- No change in the real estate tax proposed, keeping tax rate at $1.23 per $100 in assessed value. Because of the increased assessed values, the new median home value in Falls Church is now $923K and assuming no changes to the tax rate, the median homeowner tax bill will increase by $364.

- The vehicle property tax rate is proposed to increase 50 cents (from $4.30 to $4.80 per $100 in assessed value) but due to projected decreases in car values again, the resulting tax impact for the average car owner should be a 8.8% decrease in the tax bill.

- There are small increases proposed for stormwater and sewer due to rising costs – resulting in $11 and $15 per year increases respectively for the average homeowner.

- With rising interest rates and a lot of debt on the books already, there is no new general fund debt again planned for this year. (There is debt planned for the sanitary sewer, but that will be completely funded by developer connection fees.)

(2) Non Budget Business

We unanimously adopted new code that provides flexibility on parking requirements to enable permanent outdoor dining (it was allowed under temporary measures during the pandemic), adopted updates to the Neighborhood Traffic Calming Program (start here if your neighborhood would like to traffic calming measures), announced the appointment of the new City Attorney.

What’s Coming Up:

Monday, April 3 – City Council Work Session*

Monday, April 10 – City Council Meeting* – First Reading of Budget/Advertisement of Tax Rates

Monday, April 24 – City Council Meeting*

Wednesday, April 26 – Ask the Council Office Hours (City Hall, 9 am)

Thursday, April 27 – Budget Town Hall #2*

Monday, May 1 – City Council Work Session – Final Budget Markup*

Monday, May 8 – City Council Meeting – Final Budget Adoption*

*every Monday (except 5th Mondays and holidays) at 7:30 pm. You can access the agenda and livestream here, including recordings of past meetings