Updates from Letty – October 21, 2022

Blog posts are the personal views of Letty Hardi and not official statements or records on behalf of the Falls Church City Council

Dear Friends,

Thank you for all the responses following last week’s post about the Founders Row theater – I’m glad it was helpful in dispelling the common misunderstandings about how the tax sharing will work. This week’s post is continuing on the theme of dollars and cents. You may be hearing that we have a $4M budget surplus, but as always, there’s more nuance beyond the headline. Read on for more details.

Also – a note to those who have been following the Transitional Zones topic (T Zones) – the Planning Commission and other boards are discussing T Zones this fall/winter in various public meetings. A listening session is scheduled for November 2. If you’d like to come up to speed on T Zones, my Jan 2022 and May 2022 posts may help.

Best,

Letty

PS – Due to interviews for a new City Attorney, we will *not* be holding monthly Meet the Council office hours in October. We welcome public comment via email and at all of our regular meetings. For a more informal opportunity, come volunteer with us this Saturday morning at the Fall Community Clean Up!

What Happened This Week:

FY22 Year End Report

For the FY22 fiscal year that wrapped up in June 2022, we’re ending with a $4M surplus, derived from a combination of a $3.2M revenue surplus + $800K in underspending. While that appears to be good news, let’s dive into the specifics as there are a few area to watch. Note: because the underspending is only about 0.8% below budget, primarily due to staff vacancies and turnover, I’m going to concentrate on the revenue side:

“Wow – revenues are up a lot!” Revenues outperformed the budget for a few reasons: the FY22 budget was set in spring 2021 before there was broad Covid vaccine rollout and hence revenue projections were more conservative. Our local economy has been outperforming in sales tax, meals tax, and business/professional license (BPOL) tax the past few years. Local taxes make up about 25% of our total revenues. Great job living local, Falls Church!

“How does this compare to 2019 (aka, the before times)?” In general, most local revenues have returned to pre-Covid levels, especially meals tax which has had a strong recovery and is 14% over FY19. BPOL also continues to grow across all industries. Hotel tax is recovering, but receipts are still around 60% of pre-pandemic levels.

“Are we prepared for a potential downturn?” Besides our strong local economy and real estate base, we have built up very healthy reserves to cover the large debt service from the high school, library, and city hall projects. Two of the main reserve categories are the Unassigned Fund Balance, aka the city’s rainy day fund, where we have a city policy that requires keeping the UFB funded at 12-17% of expenditures (and we consistently come in at the 17% end) and a separate Capital Reserves fund that we specifically built up in order to pay for the high school. Beginning in FY23, we will be coming off the peak of the super high debt service while we still expect to receive continued land payments from the West Falls project underway (see slides for 15-16 for specific charts of projections for both reserves).

Cautionary notes

- Sales tax actually came in 1.7% *below* the budget, which could be an important warning sign. During Covid, online sales and grocery store sales drove a surge in overall sales taxes, and that spending behavior may be waning. In addition, there is continued uncertainty around whether Richmond will cut grocery taxes which would have a sizeable impact for local governments.

- Also, while many local taxes have been performing well and make up 25% of our tax base, real estate taxes are still the largest contributor at 60% of our revenues, so it will be important to watch home values in light of the real estate market cooling off.

- Obviously macro factors like Ukraine, inflation, supply chain disruptions, and rising interest rates are additional risks that could dampen revenues and increase expenditures.

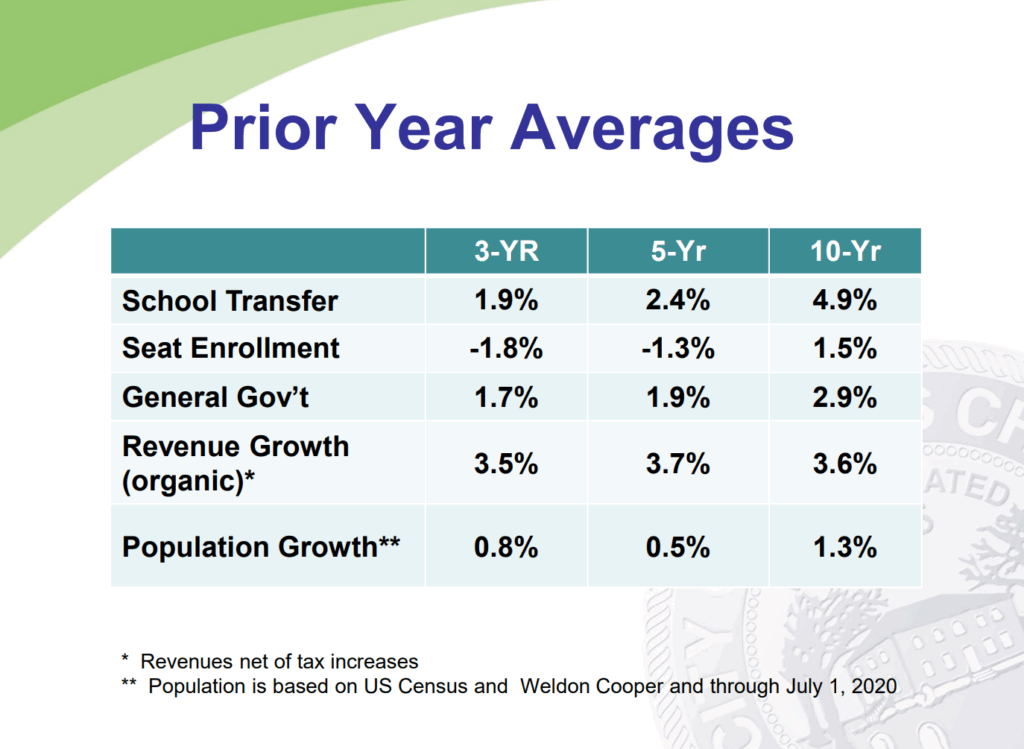

“What does this mean for next year?” Looking ahead, tax revenues will need to increase by 4.4% over FY22 actuals in order to meet FY23 budget projections. Based on the revenue trends showing continued recovery from the pandemic, so far, projections are mostly in line with current market indicators. But note that organic revenue growth from 3, 5, and 10 year historical averages have been about 3.5%, so 4.4% growth is on the high end.

“Wait, what are you doing with the $4M surplus?“

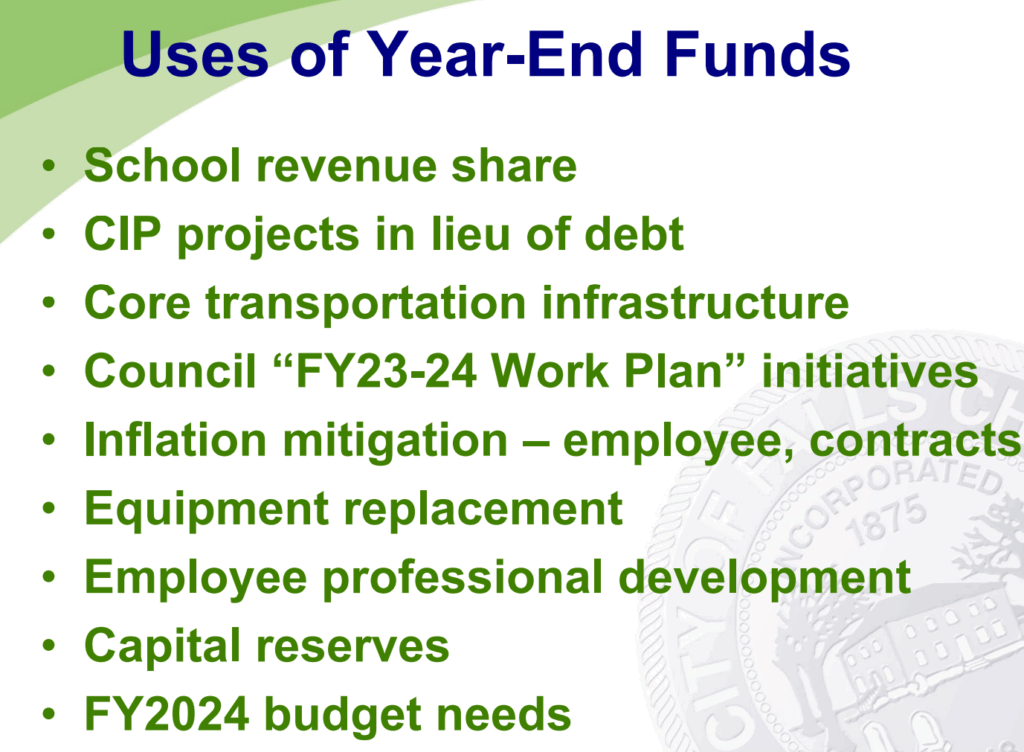

We began the initial discussion this week on potential uses of the surplus. To be clear, there won’t be a $4M spending spree. In order to keep the Unassigned Fund Balance at the 17% end of policy, staff recommends putting in additional funds into reserves. And per the informal revenue sharing agreement with FCCPS, $1.1M would be shared with the School Board, leaving about $2M available for one-time uses (one-time funds like surpluses should not be spent on ongoing operational needs).

In early November, we expect to have a further discussion on the priorities for surplus and then the budget amendment ordinance would be voted on at the end of November.

I would welcome community input on the potential uses for the year end surplus funds. Below is a *draft* list staff presented this week:

What’s Coming Up:

Monday, October 24 – City Council Meeting*

Wednesday, November 2 – T Zones Listening Session

Monday, November 7 – City Council Work Session*

Monday, November 14 – City Council Meeting*

Monday, November 28 – City Council Meeting*

*every Monday (except 5th Mondays and holidays) at 7:30 pm. You can access the agenda and livestream here, including recordings of past meetings