Updates from Letty – October 22, 2021

Blog posts are the personal views of Letty Hardi and not official statements or records on behalf of the Falls Church City Council

Dear Friends,

This week’s update will be heavy on dollars and cents. If you care about the city’s finances, how we fared during the COVID year, or the plans for the federal COVID relief money we’re receiving, I hope you’ll read on. Sometimes budget-speak makes eyes glaze over, so I’ve been committed to using these posts to make that information accessible and easier to understand. Fiscal responsibility is a big part of our job (and it’s not just during budget season each spring!) – it starts with making sure our community has both the information and the opportunities to engage. Take note of two town halls and other channels for input coming up. I’m also happy to hear your questions, comments, and ideas directly.

Next week’s City Council meeting is a regular meeting, which means you can give live public comment (either in person or via MS Teams) on any topics. Among other agenda items, the One City Center project I’ve written about in the past will be up for a first reading vote.

Best,

Letty

What Happened This Week:

(1) FY21 Year End Financial Review – the city ended Fiscal Year 2021 (FY21) on June 30th, so mid fall is usually when we review the year end finances.

- Headline: the city is projected to end FY21 with a $3.1M surplus, due to a combination of revenues coming in better than expected and underspending due to challenges in filling vacant positions. (Separately, the schools are ending the year with a $900K surplus, largely due to underspending.)

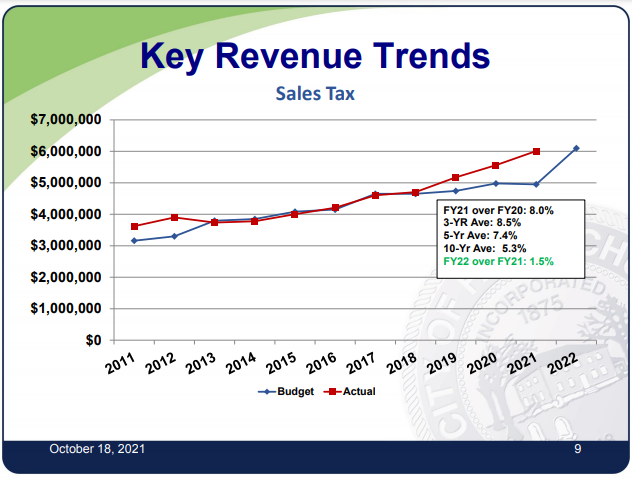

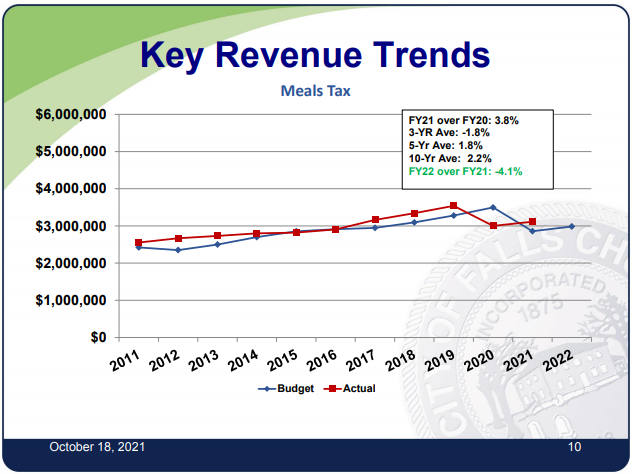

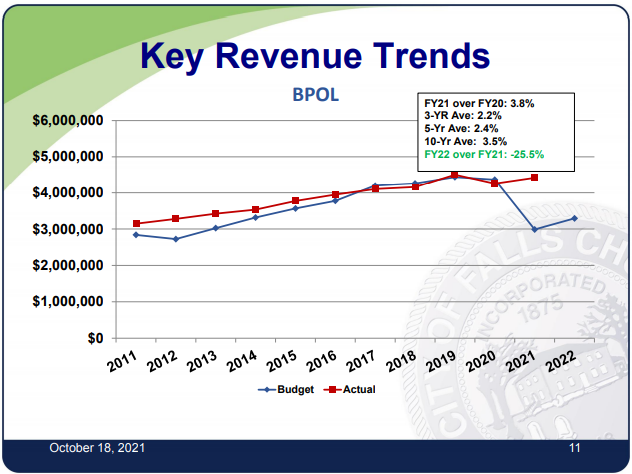

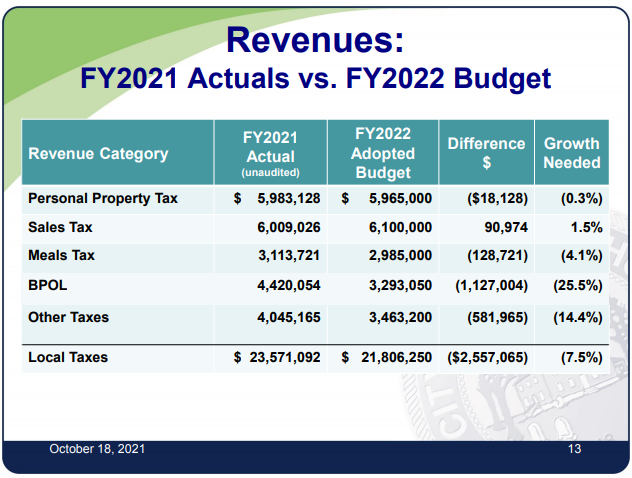

- Good news: revenues came in $1.7M higher than expected which is about 1.6% higher, mostly due to business and professional taxes, meals taxes, and sales taxes from online and grocery stores performing well. While it seems we have “weathered the storm” – it’s important to note we are not at pre-pandemic levels everywhere and some sectors continue to be disproportionately impacted. For example, meals taxes (a proxy for how our restaurants are doing) are at 94% of pre-pandemic levels in contrast to hotel taxes are at 40% of pre-pandemic levels.

- More good news: perhaps due to conservative budgeting this past spring while we were still firmly in the midst of the pandemic – local revenues from this fiscal year are already ahead of next year’s projections by 7.5%. In other words, if the local economy performs exactly the same next year as it did this year, we’d be 7.5% above what we need in next year’s budget. Recall we already cut the tax rate by 3.5 cents in this coming/new budget year, so this might signal more room for future tax rate decreases.

- Not so good news: the other half of the budget shows a $1.5M in underspending, mostly due to staff vacancies and turnovers. In fact, the City Manager reported that we are short 15-20% of the workforce, or about 1 out of every 5 positions. Staff has conducted salary benchmarking in certain job categories and adjusted pay to be more competitive in retaining employees. Local salary competitiveness is certainly a factor, but we are not immune to the labor shortage ie, the Great Resignation, across the US.

- Letty’s thoughts: in the coming weeks, we’ll be considering the uses for the $3.1M surplus. Because this is considered “one-time” money, we need to be prudent in not using this money to fund ongoing operating expenses, like salary increases and new FTEs, unless there is money in next year’s operating budget to cover that expense or the positions are strictly term limited positions. In contrast, employee bonuses and backlogged projects could be better uses. There was discussion to use the surplus to give another tax rate cut or rebate to taxpayers. While it would be a popular move, we should make sure it’s sustainable and the current staffing issues and top unfunded needs are addressed first. We know that we are not out of the woods with the pandemic and there continues to be recovery needs across the city.

(2) American Rescue Plan Act (ARPA)

I’ve written about ARPA in the past, but it probably bears repeating given the questions I’ve fielded:

- How much? The City has been allocated $18M in ARPA funding in two tranches ($9M was received in June, second tranche expected next year) – with the requirement to encumber the funds by Dec 2024 and to spend the funds by Dec 2026.

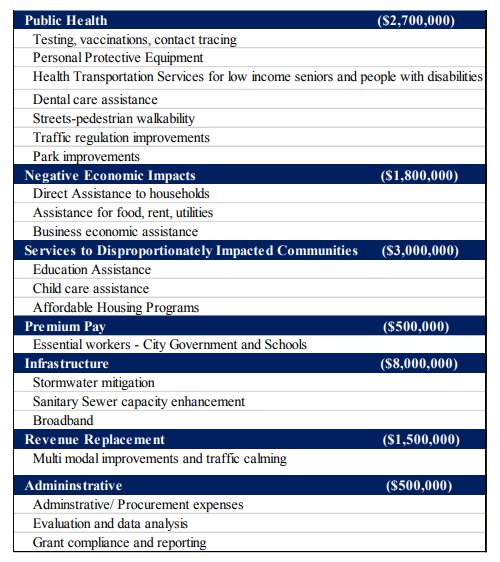

- How can it be used? This is not a blank check. There are various rules on the types of expenditures that qualify. And because it’s federal money, it requires more paperwork and potentially longer lead times on projects. That said, it’s still a huge opportunity to help our community recover and invest in long term infrastructure and transformational change.

- We’ve allocated $1M out of the $18M (about 6%) already towards high priority needs including: continued rent/utility/food assistance to supplement state funding, targeted vaccine outreach, technology improvements to enable remote work, school mental health professionals, stormwater projects, and signs for reduction in speed limits to 20 mph.

- What’s next: staff has come up with a preliminary investment plan that we discussed this week. Keep in mind that these are only draft figures. Community outreach and input from residents and businesses will be collected in the next month, with the plan updated and due to back to City Council in mid November. Take note of two town halls coming up as opportunities to ask questions and provide feedback. You can also send comments to City Council directly anytime.

Letty’s thoughts: as it stands, there is a good balance between truing back to the spirit of the ARPA funds in helping those hardest hit recover from the pandemic and making long term investments in the city like affordable housing and stormwater. Note the $8M proposed allocation to stormwater mitigation projects – the largest line item – which otherwise would have to be paid for with a stormwater fee increase. Pay equity across front line workers is also personally important to me – in previous federal funding, only certain job categories could receive hazard pay, so this is a good opportunity to ensure all front line workers in City Hall are recognized and compensated fairly. Finally, I hear the community request loud and clear for additional pedestrian safety measures – from enforcement (officers or automated) to more sidewalks and bike lanes to spot improvements like crosswalks and HAWK signals. To the extent those projects qualify under ARPA (and if not, from the FY21 budget surplus from above), I’ll continue to advocate for it.

(3) Founders Row 2

I joined the neighborhood in a walking tour of Founders Row 2 this week. The project is not perfect and has a ways to go as it works through the boards and commissions reviews. If you couldn’t join the tour or yesterday’s town hall, you can still make your voice heard and get your comments addressed. I expect the developer will be incorporating improvements based on resident input ahead of another submission this winter.

What’s Coming Up:

Monday, Oct 25 – City Council Meeting*

Wednesday, Oct 27 @ 7 pm – ARPA Town Hall #1 (virtual)

Thursday, Nov 4 @ 12 pm – ARPA Town Hall #2 (virtual)

Monday, Nov 8 – City Council Meeting*

*every Monday (except 5th Mondays and holidays) at 7:30 pm

You can access the agenda and livestream here, including recordings of past meetings

Elections 2020 – General Election on Tuesday, November 2

- Early voting info

- Thursday, Sept 30 at 730 pm – League of Women Voters & VPIS virtual candidate forum – City Council Candidates Video: https://www.youtube.com/watch?v=vSxQwNjGuNU

- Thursday, Oct 7 at 730 pm – League of Women Voters & VPIS virtual candidate forum – School Board Candidates Video: https://www.youtube.com/watch?v=JgXSsN0AE2Y

- Thursday, Oct 14 at 7:30 pm – Citizens for a Better City – City Council Candidates Forum (virtual)

- Thursday, Oct 21 at 7:30 pm – Citizens for a Better City & PTA – School Board Candidates Forum (virtual)

- League of Women Voters – vote411.org voter guide

- Falls Church Democrats Questionnaires for City Council candidates and School Board candidates

- Village Preservation & Improvement Society Candidate Questionnaire