Updates from Letty – Sept 30, 2016

Blog posts are the personal views of Letty Hardi and not official statements or records on behalf of the Falls Church City Council

Dear Friends,

Happy last day of September! As you make your weekend plans, there’s a good chance that youth sports could be delayed or canceled tomorrow morning due to wet fields – so if your morning is now free, join us and your neighbors for two events happening in the Little City tomorrow:

- Community Visioning Workshop from 9 am – 11 am, Columbia Baptist Church. If you missed the first session over the summer or have ideas on what the vision should include, here’s your chance to shape the future of Falls Church.

- If you would to give back and help the environment (or have kids or organizations looking for a service opportunity) – you can make an immediate difference tomorrow. The Fall Community Clean Up Event will happen from 10 am – 2 pm, meeting outside the Community Center. (FCCPS elementary families – this is one of the October Earthwatch activities!)

This week’s regular meeting agenda was fairly light, so we followed it up with a work session focused on the City’s financials. We reviewed both the year end financial report for FY16 and proposed revisions to financial policies, which were last updated in 2001 and 2011. The details can get technical and admittedly dry, so I’ll do my best to recap and make it easy to understand. And for the budget and money wonks out there, this is a good preview of what’s to come – the CFO will provide budget guidance later this fall, prior to FCCPS and General Government crafting their FY18 budgets.

One last plug! I know many have been following the GMHS/MEH Campus project. Now that we’re restarting the process (for new readers, you can read my blog post on why I had advocated for stopping the PPEA process back in June). External consultants and staff have been working on mapping out a new path forward, including key questions to tackle and a process to include more community input. Also, some of the revisions to financial policies we reviewed this week are in preparation for the extraordinary expense of this project. City Council and School Board are holding a joint work session for the first viewing and discussion of the new plan in a work session next Monday, Oct 3 at 730 pm in the Dogwood Room of City Hall – it is open to the public.

Stay dry, and I hope to see many of you this weekend and Monday night. Feel free to send me questions or concerns re: the money topics from this week!

Best.

Letty

What Happened This Week:

City Council Meeting & Work Session – 9/26/16

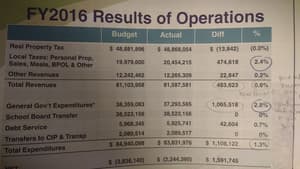

(1) FY16 Year End Financial Report – the TL;DR version is that the preliminary (unaudited) results from FY16 is that we’re ending the year with a surplus, due to a combination of better than expected local tax revenue (personal property, sales, meals, BPOL taxes) and underspending in General Government. The net result is we are ending the year ahead by $1.6MM above forecast, which is only a 1.3% difference in a $83MM budget. Three documents that may be helpful: the CFO’s memo that summarizes the results, Powerpoint deck reviewed on Monday, and summary of detailed revenues and expenditures. A few highlights:

- Expenditures – the main driver of the positive year end picture for FY16 is underspending by $1.1MM, half due to staff restricting spending due to earlier concerns about revenue shortfall, some due to lower utilization of social services, and some due to staff turnover and vacancies.

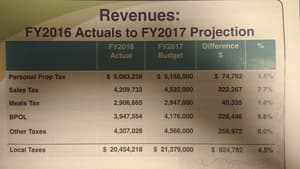

- Revenue – the other driver of the surplus is local tax revenue performed better than expected – ahead by $470K. Local taxes represent about 25% of the City’s revenues and has been growing modestly 3-4% over the last few years. In order to hit FY17 revenue targets, we will need local taxes to grow 4.5% (in some areas like sales taxes – almost 8% above what we saw in FY16). The CFO and City Manager commented that due to the new development projects coming online, 4.5% revenue growth does not seem unreasonable. 1st quarter results from FY17 will be available in October, so we’ll be monitoring closely.

- Unassigned Fund Balance (aka Rainy Day Fund) – one of the long standing City policies is to reserve 12-17% of expenditures in the Unassigned Fund Balance, with 17% being 2 months of operating expenses for the City – similar to how you might have liquid funds to cover several months of household expenses in case of emergency. After maintaining 17% ($14MM) in the Unassigned Fund Balance, the new available surplus is $920K to be carried forward into FY17, put in capital reserves, or fund unmet needs. Staff is recommending the $920K be allocated to Capital Reserves given the significant capital project agenda we have coming up – but ultimately the decision will be made by the City Council later this fall.

- Capital Reserves – I think of Capital Reserves as the “piggy bank” – funds saved and earmarked for future capital projects. We have $11MM in Capital Reserves – comprised of funds from the sale of the former USPS property ($1.6MM) and Water System ($9.3MM). This may seem like a large amount of savings, but compared to a forecast of $145MM in debt in future years through FY2021 – $11MM is not very much. Although current policy calls for contributing $500K/year to Capital Reserves, due to tight operating budgets – contributions haven’t been made since the policy was adopted in 2011.

- Developer Contributions – as you may know, the most recent development projects have made voluntary concessions for school capital costs. Northgate provided $680K, West Broad/”Harris Teeter building” contributed $2MM (received this spring), and Lincoln at Tinner Hill just contributed $1.6MM (received this week) – all of which are planned for use for Mt. Daniel construction. A clarifying point – given that we’re planning to spend a combination of bond money and developer payments for Mt. Daniel, the City Manager and CFO confirmed that bond money will be spent first, which is an important detail because of the limitation of the bond proceeds to only be used at Mt. Daniel.

(2) Financial Policies Update – the City’s financial policies were first adopted in 2001 and then updated in 2011, and staff is now recommending several updates. Financial policies are important guidelines for financial decision making, provide investor confidence, and encourage transparency and accountability. Most of the policies are largely unchanged; some of the proposed changes reflect best practices and some are changes to the newer 2011 policies to prepare for the ambitious capital plan ahead.

- 2001 policies – set targets for Unassigned Fund Balance; established guideline to not use non-recurring revenues (ie, surplus in fund balance) for ongoing expenses like operating budgets and to only use for one time expenses; set debt caps to minimize borrowing risk (caps for both debt service and total debt).

- 2011 updates – during the recession recovery period, the policies were updated in these areas: increased targets for Unassigned Fund Balance, established Capital Reserves, set debt pay out ratios to further minimize borrowing risk.

- Proposed 2016 updates

- Modifies pension funding requirements.

- Clarifies use of Unassigned Fund Balance – allows use of the “rainy day fund” if there is an emergency revenue shortfall of at least 2% below budget.

- Sets a “Pay As You Go” (ie, cash – not bonded/debt financed) capital contribution target of $1MM/year to maintain or replenish existing infrastructure. The idea is that not all of our capital needs should be debt financed – especially for assets like school buses and other vehicles, machinery, and transportation projects that have a shorter life span than buildings/facilities which are traditionally debt financed. This cash funding target would be over and above the $500K/year funding target for Capital Reserves. If we were to adopt this new policy and meet both components ($1.5MM combined) in the next budget, that would be equivalent to 4 cents on the real estate tax rate.

- Finally – two components that prepares us to be able to finance some or all of the GMHS/MEH campus project : 1) that capital reserves may be used for annual debt service in exceptional circumstances and 2) create flexibility for longer pay out ratios.

- The mark up of the policies and PowerPoint presentation provide more detail, including new slides modeling financing scenarios for GMHS/MEH and future capital needs and interaction with various financial policies.

*Expect both discussions on FY16 budget review and the proposed Financial Policies to come back into a regular meeting later in October *

What’s Coming Up:

TOMORROW Oct 1, 9 – 11 am at Columbia Baptist Church – Community Visioning Meeting #2. Join your neighbors, City officials, staff, and guest speakers to discuss survey results and what you think The Little City look and feel like in 25 years.

TOMORROW Oct 1, 10 am – 2 pm – Fall Community Clean Up & Litter Pick Up – Clean up the City and keep litter out of our waterways. Meet at the Community Center to pickup supplies (provided by the City) and then spread out across the City to the areas of highest impact.

Monday, Oct 3, Joint Session with City Council and School Board on GMHS/MEH Campus at 730 pm

Oct 5 – Personal Property Taxes are due. By now, you should have received your personal property tax bills. Remember that the new 10% late penalty structure is in effect for late payments.

Oct 6, 730 pm at City Council Chambers – Town Hall on the City Hall project – join City staff and the architectural firm for an update on the City Hall project. Give input on the overall concept, building flow, and more.