Updates from Letty – September 29, 2017 + Fact vs Fiction

Blog posts are the personal views of Letty Hardi and not official statements or records on behalf of the Falls Church City Council

Dear Friends,

Taking advantage of the lighter agenda we had, this week’s update will include “fact vs fiction” based on what I’m hearing around town. I’ll also explain the City’s year end financial report (including the “6 cents tax rate hike” you may have read), provide a few updates on the economic development front, and highlight upcoming infrastructure projects, including a sneak peak at the new playground at Cherry Hill Park.

I’m also starting to field questions about the candidates for School Board and City Council elections. We are fortunate to have a talented slate of candidates this year, and I hope you’re taking advantage of the opportunities to meet them and learn their positions. Having experienced campaigning two years ago, kudos to all of the candidates for endeavoring. I always say I support the folks who do the work and who will hit the ground running. While the GMHS referendum is the hot topic now – keep in mind that all of us will inherit the outcome of the voters’ decision on the referendum. I hope you’ll consider which candidates possess the qualities you think will best carry that outcome and the City forward.

Also – start thinking about Election Day on 11/7! For families with FCCPS students, Election Day falls at the end of a long weekend, so if you’ll be out of town – make plans to vote early in person absentee which is already underway.

Let’s continue the conversation at my office hours this weekend – I’ll be at Cafe Kindred on Sunday at 9 am. With several members of City Council heading to the VML conference (an association of Virginia towns and cities) and the holiday the following week, our next meeting will be Tuesday October 10th.

Read on – this should be enough content for the next two weeks! 🙂

Best,

Letty

What Happened This Week:

FY17 Year End Financial Report:

- Despite the revenue shortfalls we were concerned with earlier in the year, strong local revenues + underspending helped push FY17 into the black, by about $500K.

- Local revenues, like personal property tax, sales tax, and meals taxes, make up 25% of our total revenues and we saw strong growth in those categories. The good news is that continued economic development draws more people to spend their money here and locals who don’t have to shop or dine elsewhere are boosting our revenue numbers. For example, sales tax grew 9.4% and meals tax 8.8% over last year’s numbers.

Looking Ahead:

- Expect official budget guidance for FY19 to come out in late November/early December

- Contrary to common critique, we do look at budget projections for 5 years out, including expectations with escalating WMATA costs. You can see the latest projections on slide 17-18 here. We also started discussions on the unassigned fund balance (“rainy day fund”) and how we might need to grow that to stay within policy since our expenses could be growing precipitously with the cost of GMHS if the referendum passes.

- So what’s this 6 cents tax increase?? If you’ve been paying attention to the GMHS bond details, you know that the projected taxpayper impact is between 4-15.5 cents ($280 to $1050 per year for the median homeowner), so where is 6 cents coming from? With the City Council’s adoption of the Full CIP at the end of July – there are many other projects that require additional debt – Library, City Hall, Larry Graves turf field, etc. Those additional projects will cost 2 cents on the tax rate, hence the 6 cents total. What’s not yet in the modeling of the CIP is the addition at TJ Elementary. Of course, we are 6+ months away from deliberating and voting on a budget and these are early staff projections, so stay tuned.

Letty’s takeaway – next time you make a purchase (gas, groceries, coffee, dinner…), keep it local! It will be budget season before we know it. We’ll need to have serious debate about capital and operating budgets, especially if the referendum passes, to balance taxpayer impact with core services and needs across the City.

Economic Development Updates

- Washington & Broad – we expect to receive an updated submission from the applicant shortly, with a public walking tour of the project planned for the evening of Monday, October 16th. It will be a good opportunity to look at the proposed plans in the context of the neighborhood – with markings for setbacks, curb cuts, etc.

- New business watch – Panjshir re-opening at the Southgate/Lily Building very soon; Northside Social and Liberty BBQ have tentative November openings, Target on track for next spring. Also Cyclebar will be coming to the space next to Harris Teeter. Expect also news about a brew pub, bakery, and and cafe signing space around town too.

- ICYMI: https://www.bisnow.com/washington-dc/news/mixed-use/there-is-a-mixed-use-renaissance-happening-in-falls-church-77726

Letty’s Fact vs Fiction

In the coming month, you may hear a lot of scare tactics about the City’s finances and what you’ll be voting for in the referendum. I’ll be the first to acknowledge that there are a lot of risks in such a big financial lift. See this post and this post. However, I also know we explored many alternatives with no better financial projections, engaged experts to give us their best advice, and staff has laid out a reasonable financing plan as a result of the extensive study. I won’t tell you how to vote, but I believe it’s important for citizens to make their own decision anchored in facts. Below are actual comments I’ve heard or read this week, paired with links to the data so you can draw your own conclusion.

Send me your FAQs or fact vs fiction to be included next time! (If you missed last week’s FAQs, check them out.)

1. Renovation as an option is not off the table, even if the bond referendum passes.

Fact. Technically the language in the referendum authorizes us to take out up to $120M in debt for “constructing, expanding, reconstructing, renovating, equipping and/or reequipping, in whole or in part, a new or improved high school and part of a middle school”. If you vote yes, you’re voting to allow the City to borrow money for those purposes outlined. The referendum language was a conscious and careful balance in being narrow enough to meet state requirements while not being overly restrictive as a learning from past projects. The preferred option (and the one for which the School Board voted) is new construction because the renovation options cost nearly as much as new construction without the possibility of economic development offset.

That flexibility is also important because I believe we need to be able to adjust if circumstances change and to mitigate risk. For example – if passed, the $120M debt would not be issued all at once and currently planned to be issued in 3 tranches. We would only issue the 2nd and 3rd most costly tranches, about 85% of the debt, after we have an signed agreement with a developer with a plan for the 10 acres. We could delay or reduce the project scope otherwise.

2. Mixed use development is a money loser for the City

Fiction. This is the City’s 2017 report on the mixed use projects. It’s subjective whether you like the aesthetics of the new mixed use buildings or the new businesses that opened or really miss what was replaced, but objectively – the facts are clear. 7 out of 8 mixed use projects are fiscally net positive for the City. Note: the numbers are annual net figures, not gross. Pearson Square continues to be the outlier, as an outcome of the conversion of the condos to apartments during the housing crisis. Also take note of the cash contributions made to schools, parks, library, etc from each project and the value generated by the parcels, pre-development – you’ll see that many of the properties were underperforming and under-utilized spaces.

3. New development is flooding the school system with students

Fiction. It’s a common misconception that our school capacity issues are due to mixed use development. This is the latest data on students by housing type – you’ll see that we have diversity in housing types and the majority of the students and growth in student enrollment originate from existing housing stock (ie, single family home turnover, townhomes, older apartment buildings) that we cannot control. What we can control is whether we build mixed use and the mix of uses within mixed use. And I believe we can continue to thoughtfully build mixed use in a way that it’s a net financial benefit, adds housing diversity, bring new options for dining, shopping, and services without radically changing the character of the Little City.

The 2017 data collection is underway and I’ll share when it’s available.

4. $40M is a dubious value for 10 acres of land at GMHS campus, so you can’t trust the City’s tax rate projections.

Fiction. Without a crystal ball into the future, I agree that we have no guarantee on the value of the 10 acres of land for development, especially when the value is dependent on the economy and third party developers, factors we cannot control. However, multiple sources point to $40M being a pretty reasonable estimate. The City has engaged experts who have weighed in and concurred around a similar figure assuming current economic conditions hold. The 2014 Urban Land Institute “Technical Assistance Panel” (ULI TAP) of area real estate experts and practitioners concluded that market interest in this land would be high due to its excellent location near Metro and I-66 and could defray 50 to 80% of the cost of the school, using the assumptions available at that time. Most recently, Alvarez & Marsal, a commercial real estate advisory firm, estimates the City could potentially earn roughly $43-45M for a long-term lease or sale.

You may also have heard figures quoted based on recent sales of commercial property. 100 N. Washington (corner of Broad and Washington) is one of the most recent commercial property sales. If you reference the sales data for 100 N. Washington, you’ll see it sold for $13.6M, or about $116 per square foot. Extrapolated to 10 acres at the GMHS site, $116 per square foot would translate to $50M; one could also argue that the land adjacent to transit would be even more valuable.

5. Budgets are growing uncontrollably and we will have enormous debt.

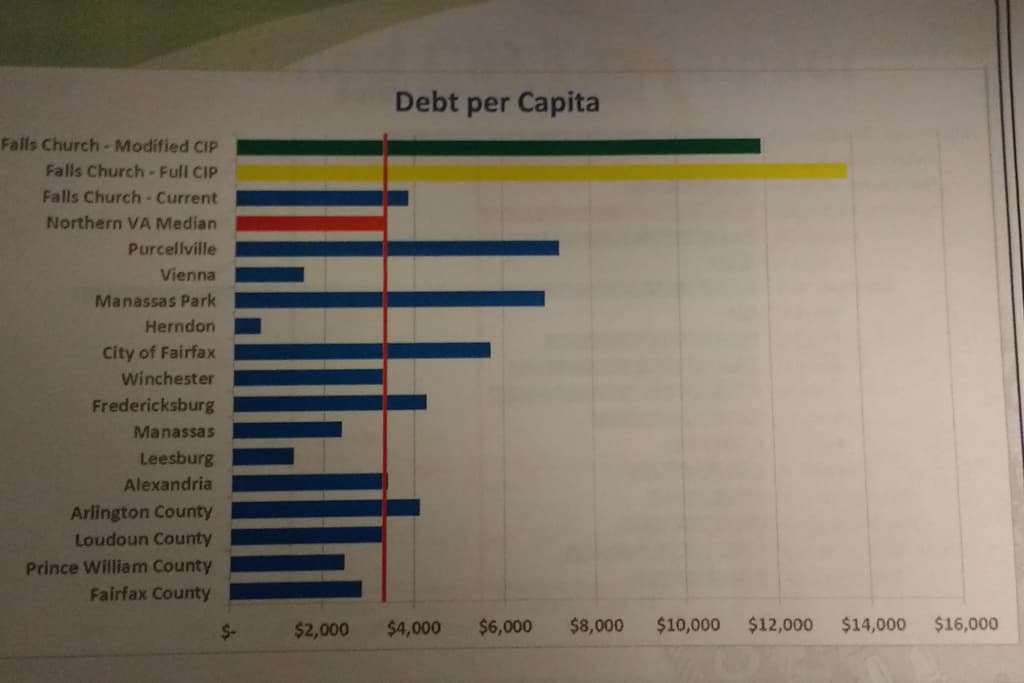

Fact and Fiction. Yes if the referendum passes, with the adoption of the full CIP, we will have the highest debt per capita in the region and will also be exceeding our of 12% cap for debt to expenditures policy. Unless we agree to do nothing with GMHS, even the cheapest repair, renovate and expand option would impact this metric. We have been preparing the bond rating agencies and consulting with our financial advisors about the possibility of this once in a generation expense to minimize the risk of a credit downgrade.

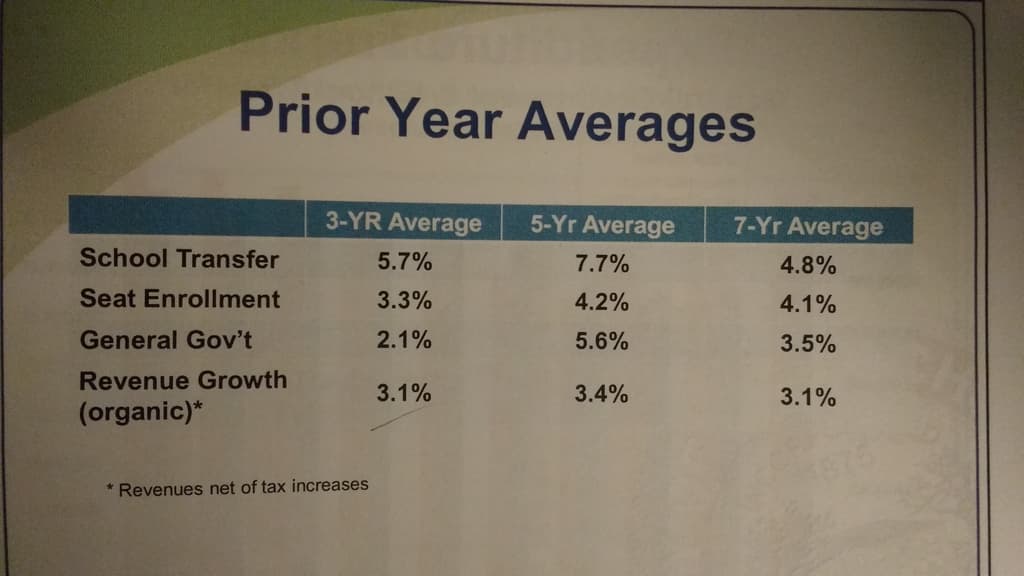

As for operating budgets – below is a chart for budget growth across general government and schools vs student enrollment growth the past 7 years. So while it’s correct that school budget growth has outpaced student enrollment growth and also outpaced organic revenue growth, hence necessitating some years with tax rate increases – what’s not shown on the chart is the recent statements made by the Superintendent and School Board share the need to be fiscally disciplined with operating budgets when taking on huge capital costs.

Infrastructure Projects – Your Tax Dollars At Work!

It’s going to be a busy few months with several large infrastructure projects about to get underway across the City. It’s exciting to see progress and tax dollars implementing priorities we hear from citizens – parks, walkability, traffic calming! However, some work will be disruptive and will require patience from all of us

- Cherry Hill Park – get a sneak peak of the playground equipment replacement with the online video or visit the park to see the footprint of where the new equipment will be installed. From Oct 9 through early December, construction will be underway.

- Roosevelt Pedestrian Work – the goals of the project are to upgrade pedestrian access along the corridor and make Roosevelt Street, Roosevelt Corridor, Ridge Place, and E. Broad a safer route for all users. Work will start next week until next spring.

- S. Washington Multimodal Transit Plaza – the first phase of the project, utility undergrounding, is underway on S. Washington from Tinner Hill Road to Annandale Road and will last through spring.

- Traffic calming projects on N. Maple, N. West, and Lincoln Ave – starting soon!

What’s Coming Up:

- TODAY – Friday, September 29 at 730 am, Dogwood – Campus Economic Development Working Group

- Sunday, October 1 at 9 am, Cafe Kindred – Letty’s Office Hours

- Tuesday, October 10 at 730 pm – City Council Meeting

- Monday, October 16 at 630 pm – Walking Tour of Broad and Washington Project, 301 West Broad, Lincoln at Tinner Hill